Big names like Bulb Energy and Avro Energy collapsed alongside smaller suppliers such as Green, PFP Energy and Symbio Energy, with problems set to continue into 2022.

The main factor behind these collapses is the rising wholesale cost of energy that has spiked to unprecedented levels in 2021.

Yet regulator Ofgem has also been criticised for failing to step in earlier and the spotlight has been turned on whether energy companies have been poorly managed too.

Which energy suppliers have collapsed?

2021 saw 28 energy companies fail.

Collapsed suppliers are listed alphabetically in the table below along with details of how many customers they had and which energy supplier took on those customers.

| Supplier name | Date of collapse | Number of customers | Customers taken by |

|---|---|---|---|

| Ampoweruk Ltd | 2 November 2021 | 600 + 2,000 non-domestic | Yu Energy |

| Avro Energy | 22 September 2021 | 580,000 | Octopus Energy |

| Bluegreen Energy Services Limited | 1 November 2021 | 5,900 domestic + non-domestic | British Gas |

| Bulb Energy | 24 November 2021 | 1,600,000 + 12,000 non-domestic | Special administration - see below |

| CNG Energy Limited | 3 November 2021 | 41,000 non-domestic | Pozitive Energy |

| Colorado Energy | 13 October 2021 | 15,000 | Shell Energy |

| Daligas | 14 October 2021 | 9,000 domestic + non-domestic | Shell Energy |

| ENSTROGA | 29 September 2021 | 6,000 | E.ON Next |

| Entice Energy (including Simply Your Energy Limited) | 25 November 2021 | 5,400 | Scottish Power |

| GOTO Energy | 18 October 2021 | 22,000 | Shell Energy |

| Green (Green Supplier Limited) | 22 September 2021 | 255,000 + non-domestic | Shell Energy |

| Green Network Energy | 27 January 2021 | 360,000 | EDF |

| Hub Energy | 9 August 2021 | 6,000 + 9,000 non-domestic | E.ON Next |

| Igloo Energy | 29 September 2021 | 179,000 | E.ON Next |

| MA Energy Limited | 2 November 2021 | 300 non-domestic | SmartestEnergy |

| MoneyPlus Energy | 7 September 2021 | 9,000 | British Gas |

| Neon Reef Limited | 16 November 2021 | 30,000 | British Gas |

| Omni Energy Limited | 2 November 2021 | 6,000 | Utilita |

| Orbit Energy Limited | 25 November 2021 | 65,000 | Scottish Power |

| People's Energy | 14 September 2021 | 350,000 + 1,000 non-domestic | British Gas |

| PFP Energy | 7 September 2021 | 82,000 + 5,600 non-domestic | British Gas |

| Pure Planet | 13 October 2021 | 235,000 | Shell Energy |

| Simplicity Energy | 27 January 2021 | 50,000 | British Gas Evolve |

| Social Energy Supply Ltd | 16 November 2021 | 5,500 | British Gas |

| Symbio Energy | 29 September 2021 | 48,000 + non-domestic | E.ON Next |

| Utility Point | 14 September 2021 | 220,000 | EDF |

| Zebra Power Limited | 2 November 2021 | 14,800 | British Gas |

| Zog Energy Limited | 1 December 2021 | 11,700 | EDF |

Overall, this means around 4.2 million energy customers have been displaced in 2021.

We'll look at the reasons for the energy crisis in more detail below, but it's also worth pausing to consider more carefully where those customers have gone.

A large chunk of these (2.4 million domestic customers) have been transferred to five major suppliers: British Gas, EDF, E.ON Next, Octopus Energy and Shell Energy.

These are the number of domestic customers taken on by those five in 2021:

| Supplier | Number of new domestic customers |

|---|---|

| British Gas (inc British Gas Evolve) | 465,200 |

| EDF | 580,000 |

| E.ON Next | 239,000 |

| Octopus Energy | 580,000 |

| Shell Energy | 536,000 |

The way suppliers acquired their new customers varied.

For instance, Octopus Energy took over Avro Energy's 580,000 customers in one large chunk, and that marks the total of their customer transfers so far.

Yet British Gas took on customers from eight failed suppliers including 350,000 from People's Energy while E.ON Next and EDF took on customers from four and three failed suppliers respectively.

As noted in the table, the process for Bulb Energy was slightly different, so let's take a closer look at that unique situation.

Bulb Energy

Bulb Energy was the biggest casualty of the 2021 energy crisis, having over 1.6 million customers at the time of their collapse on 24 November 2021.

Unlike the rest of the suppliers mentioned in the table above, Bulb were deemed too big to fall into Ofgem's usual safety net and a Special Administrator Regime (SAR) was arranged instead.

Essentially, this means the supplier's customers and debts are being backed by the Government until a longer-term solution can be found.

The process for a SAR was enshrined in law back in 2011 but it hadn't been required until Bulb got into difficulties.

At the time of writing, it isn't clear what route the Government will take to get Bulb out of the SAR, although all customers can rest assured their lights will stay on and their credit balances will be protected.

Why are so many energy suppliers collapsing?

The number of energy suppliers who collapsed in 2021 was unprecedented.

We've seen suppliers fail before. There was a spate in 2018 and early 2019, for example, with 10 collapses between January 2018 and March 2019 displacing almost 850,000 customers.

A huge chunk of those customers came from two suppliers: Spark Energy which had 290,000 customers and Extra Energy which had 108,000.

Yet the number of customers affected in 2018/19 dwarfs in comparison to the 4.2 million affected in 2021, so what's going on?

Wholesale energy costs

The main problem for energy companies has been the rising cost of gas and electricity on the wholesale market. This isn't just a problem for UK energy suppliers - it's a global problem.

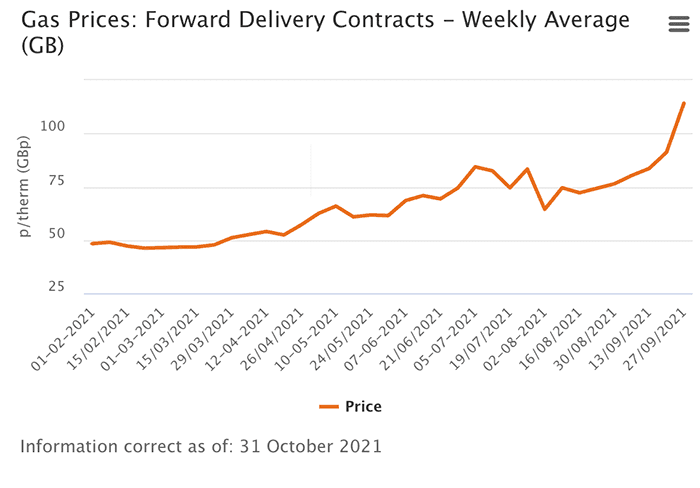

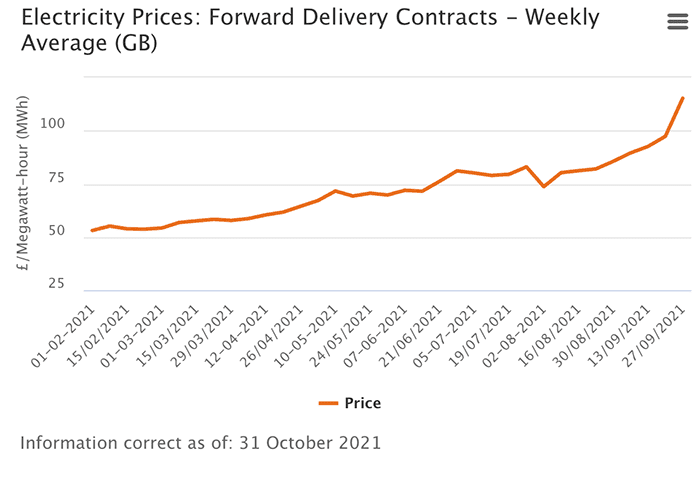

We can see how much prices have spiked by looking at a few charts from regulator Ofgem.

Suppliers buy their energy in advance on the wholesale market and there has been a sustained rise in the prices they've faced.

Here is the trend for gas prices throughout 2021:

And here's how it looks for electricity:

Between February and the end of October 2021, the price of wholesale gas and electricity almost doubled, meaning even suppliers who buy their wholesale energy many months in advance are having to pay much more than they were a year ago.

With these market conditions, companies who did not buy their energy far enough in advance are particularly exposed to wholesale price changes and those who need to buy extra to meet demand will particularly struggle when prices are so high.

There are several reasons why wholesale prices have risen so much over the last year:

- Energy storage levels across the UK and beyond were pushed to a record low level due to higher usage and unseasonably cold temperatures in 2021.

- High demand for gas across Europe and reduced pipeline deliveries on the continent has had a knock-on effect on UK supplies.

- Low wind generation across Europe means more demand has been placed on electricity-generating power stations fuelled by gas.

On this last point, official data from the Department for Business, Energy & Industrial Strategy (BEIS) found renewable generation in the UK fell by 17% in Q3 2021 compared to the same period a year earlier. It fell to its lowest figure since Q3 2017.

So, the wholesale price of energy has increased, but why haven't those increases been passed on to customers yet? That's mainly due to the energy price cap.

Energy price cap

The default energy price cap was introduced in 2019 and sets a limit on the amount energy companies can charge per unit of gas and electricity for customers on standard variable tariffs (SVTs).

SVTs were historically the most expensive way to take energy from a supplier because they were reliant on the type of market changes we've discussed above and it wasn't unusual for customers to experience multiple price increases in a year.

The price cap was designed to ensure customers weren't being overcharged by energy suppliers and give them a little more confidence about the price they would pay.

Ofgem confirmed they would reassess the cap in April and October of each year to see if the costs for suppliers had gone up or down. Over the first few reassessments, this worked and prices went down for customers as well as up.

Some suppliers weren't happy with the cap (Extra Energy said it made the market unviable after their 2018 collapse) but it wasn't until the wholesale price crisis in 2021 that the shortcomings of the cap became clearer.

Since Ofgem only reassess the cap twice a year, they announced in August it would be raised to the highest level it'd ever been in October 2021.

But since that decision was made in August, the situation rapidly deteriorated and many suppliers complained it was costing them more to supply energy than they could charge for it under the cap.

Utility Point were one of the most vocal critics after their collapse in the middle of September, saying the price cap was set £200 below the costs of supplying energy.

Ofgem has belatedly conceded they need the power to alter the price cap in exceptional circumstances and they are consulting on making changes to the way the cap works. The problem is, no steps will be taken until at least February 2022 when Ofgem publish details of their next steps.

It won't help customers in the short term and may feel like shutting the stable door after the horse has bolted - or, in this case, after all the energy companies who were struggling have already collapsed.

Poor management

Another contentious argument about collapsing suppliers comes from the idea that only those who were poorly managed have failed.

Some argue that suppliers charged too little for energy in a bid to attract new customers and that has exacerbated their financial problems during the current crisis.

Back in 2019, for example, Bulb became embroiled in a public spat with SSE (now taken over by OVO) after all the major energy companies set their prices close to the price cap.

Bulb accused the big names of squeezing customers, but SSE retorted that undercharging for supply was irresponsible.

Whether this has been proven by recent events is up for debate, but various industry figures frequently point the finger at smaller providers for undercharging and failing to manage their customer base correctly.

Yet lower prices from a smaller provider didn't necessarily mean they were undercharging for energy. Smaller providers had fewer overheads and obligations than the bigger names, meaning they could charge less safely.

At the end of the day, hindsight will be used a lot to say companies should have shielded themselves against sudden price rises but, as the graphs above demonstrate, the heights have been unprecedented. How possible was it to prepare for that?

State of the UK energy market

It's clear there's no easy answer to the problem of smaller suppliers collapsing but one thing is for sure: customers and the wider public are the ones who suffer.

Customers of suppliers who collapse often end up paying more for energy in the shorter term, yet the overall costs of collapses find their way to all our bills.

If a failed supplier is caught by Ofgem's SoLR safety net, the costs incurred by a new supplier will be charged back to Ofgem and, ultimately, the taxpayer.

For example, when Tonik Energy collapsed in October 2020, their customers were taken on by Scottish Power who later put in a claim of just over £1m for incurred costs. This was made up of:

- Around £959,000 to repay customer credit balances

- Around £76,000 in working capital costs

Since few would suggest that customers should lose their credit balance if their energy provider collapses, a certain amount of expense to the taxpayer is inevitable. That will result in higher bills for us all over time as we explained in late 2018 after eight firms went bust.

One other fear is that customers will suffer from reduced competition in the energy market thanks to all these collapses.

For many customers, it isn't solely about cheaper energy. They may have had poor experiences with the big names, especially when it comes to customer service.

Our analysis of the best and worst energy suppliers for customer service found some of the best scores were recorded by smaller suppliers who have now collapsed such as Avro Energy, Igloo Energy, Green and Zebra Power.

So, if customers felt they were getting a better customer experience from smaller suppliers who have failed, does that put all of us at the mercy of big suppliers who weren't quite living up to those same standards?

Regulator Ofgem has finally confirmed their intentions to step in when the energy market is threatened in rare circumstances and they do keep an eye on smaller energy companies as they grow to check everything is financially okay.

However, critics say this decision has been taken far too late and many viable suppliers have been left to collapse while others say only irresponsible companies have failed.

Whatever your view, the real losers this year have been the 4.2 million customers displaced by collapsing suppliers and the taxpayers who will eventually foot the bill for keeping all the lights on.

What's next for the UK energy market?

The beginning of 2022 is set to be another turbulent period for UK energy customers.

With the next reassessment of the energy price cap due to be announced in February before coming into force in April, many experts are forecasting huge increases in the price per unit of gas and electricity.

The trade body for the energy industry Energy UK has warned prices could go up by 50% and it's clear Ofgem are under immense pressure from all sides to make a good decision.

Energy providers themselves have various ideas to help keep the industry afloat with one option being to create a fund where companies could draw on Government-backed cash if wholesale gas prices are too high, but it's unclear whether this would be an adequate use of taxpayer cash and whether there's political will to implement it.

Something that's often discussed is the ability of the Government to remove the 5% VAT levied on energy bills. This is touted as a quick way of cutting bills but, again, the Government doesn't seem keen to go down this route.

The idea of boosting support for the most vulnerable customers is gaining traction though and Chancellor Rishi Sunak seems keen to focus support on energy customers who can least afford to pay their bills.

However, if prices do rise by the projected 50% in April 2022, there will be many more falling into that category and it's unclear whether the Government has a plan for that eventuality yet.

Read about some of the cheap ways to cut energy bills.