Home > Money > News > ID theft rise driven by social media use

ID theft rise driven by social media use

IDENTITY theft has reached "epidemic levels" according to new research from fraud prevention agency Cifas, with much of the increase coming from the social media use of younger generations.

Cifas reported that fraud numbers for the first six months of the year had risen to 89,000, representing a 5% increase compared to the same period in 2016.

The biggest increase was among people within the under 21 age bracket, while those aged between 31 and 40 saw the highest numbers of ID theft cases, coming in at 18,916 reported incidences.

While such rises indicate an increase in online activity more generally, they're also a particular symptom of high levels of social media use, which can often see people voluntarily publicise personal info that could be used by digital fraudsters.

Loans, telecoms and insurance

The Cifas guide to protecting yourself

Just how frequent is fraud

Credit card fraud: what to do

One particularly significant finding of Cifas' latest report is that ID theft now constitutes the most common form of fraud, equalling 56% of all fraud cases their members report to them.

And rather than simply using stolen personal details to apply for credit cards or open bank accounts, fraudsters are increasingly applying for personal loans and buying "telecoms products" (e.g. phone and broadband contracts), as the table below makes clear:

| Product | Jan-Jun 2016 number | Jan-Jun 2017 number | % change |

|---|---|---|---|

| Bank accounts | 28,872 | 24,759 | -14.2% |

| Plastic cards | 33,939 | 29,852 | -12% |

| Loans | 7,472 | 11,499 | 53.9% |

| Insurance | 20 | 2,070 | 10,250% |

| Telecoms | 5,661 | 9,097 | 60.7% |

| Online shopping | 3,271 | 5,097 | 55.8% |

Source: Cifas

It's interesting to note here that insurance-related ID fraud has seen a whopping 10,250% rise over the past year, although largely because it was all-but nonexistent 12 months ago. It's also interesting to speculate as to whether this dramatic increase has anything to do with the large rises insurance premiums have witnessed recently, and with fraudsters wanting to avoid steep premiums by taking out policies under stolen or false names.

Yet regardless of the particular motivation, Cifas note that the "vast majority of identity fraud happens when a fraudster pretends to be an innocent individual to buy a product or take out a loan in their name".

They also explain that most victims don't become aware of being victimised until they receive an unexpected bill for something they didn't actually purchase, or until they discover that their credit rating has taken an unfortunate tumble.

And as Cifas' chief executive, Simon Dukes, explains, "These frauds are taking place almost exclusively online. The vast amounts of personal data that is available either online or through data breaches is only making it easier for the fraudster".

Youth and social media

Yet perhaps more significant than the particular forms of ID theft, or what stolen details are used to buy, is the demographic breakdown of victims.

As the table below illustrates, there's a relatively even spread in terms of numbers, yet certain groups have seen bigger proportional rises than others:

| Age | Jan-Jun 2016 number | Jan-Jun 2017 number | % change |

|---|---|---|---|

| Under 21 | 684 | 1,023 | 49.6% |

| 21-30 | 11,646 | 12,302 | 5.6% |

| 31-40 | 11,638 | 18,916 | 1.5% |

| 41-50 | 18,086 | 18,338 | 1.4% |

| 51-60 | 15,277 | 15,940 | 4.3% |

| Over 61 | 14,172 | 13,294 | -6.2% |

Source: Cifas

The biggest rise in percentage terms was among people aged under 21, who saw a hefty 49.6% increase. The next biggest growers were also the next youngest, with the 21-30 age bracket seeing a 5.6% growth in victim numbers.

By contrast, there was a 6.2% decrease in the number of over-61s experiencing ID fraud, although in absolute, numerical terms victim numbers in this group still exceed those of the under-21 and 21-30 groups.

They don't, however, outnumber figures for the 31-40 bracket, which is privy to more victims than any other.

That they produce more victims than any other demographic underlines that ID fraud is more of a youth-oriented crime, something which suggests the potential explanation as to why.

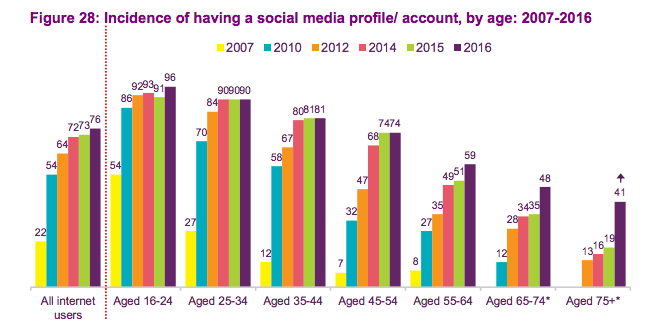

Namely, younger people are more likely to use social media, with Ofcom's Adults' Media Use and Attitudes report for 2017 finding that 96% of people aged between 16 and 24, for instance, have a social media account, compared to 76% of the general population and 48% of people aged between 65 and 74.

Source: Ofcom, Adults' Media Use and Attitudes, 2017

This is a large part of the reason why numbers of younger people being hit by ID fraud are growing faster than for older groups, since as the Head of the City of London Police's Economic Crime Directorate, Glenn Maleary, explains, people are publishing their names, addresses and dates of birth on their social media profiles.

He said, "It has become normal for people to publish personal details about themselves on social media and on other online platforms which makes it easier than ever for a fraudster to steal someone's identity".

This would explain why the biggest increases are restricted to younger segments of the population, because it's these segments who use social media most heavily, and because fraudsters are apparently relying more on social media to lift sensitive details than on more "traditional" hacking.

Deceleration and encryption

In other words, increasing numbers of people are becoming semi-voluntary victims of ID fraud, insofar as they willingly publish most of what fraudsters need to steal their identities.

Still, the situation isn't quite as bad as the above would suggest, since even though Cifas have used the word "epidemic" in describing the number of cases, this number has risen by only 5%, when in 2015, for instance, it rose by as much as 27%.

As such, the rate of increase may in fact be slowing, as people become increasingly aware of the need to update their internet security software, to change their passwords regularly, and to avoid doing sensitive things (e.g. internet banking) while using public wifi.

And as for the increasing role of Facebook and other personal data factories, the danger they pose can be sidestepped to a large extent if people simply avoided publishing sensitive info, and if they turn their privacy settings to the maximum (admittedly against the whole purpose of social media, but still).

Nonetheless, given that the Government, for instance, is actively beavering away to introduce backdoors into the encryption websites often employ to protect their users, other threats to internet security are likely to arise to replace those the public take due care to avoid.

Get insider tips and the latest offers in our newsletter

Get insider tips and the latest offers in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties