Home > Money > News > UK state pension lowest of all OECD nations

UK state pension lowest of all OECD nations

THE UK state pension is the lowest among the world's 35 richest nations, according to a new study by the Organisation for Economic Co-operation and Development (OECD).

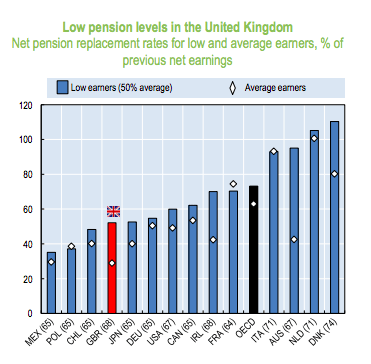

The "Pensions at a Glance 2017" report studied the pension systems of the 35 member states of the OECD, concluding that the UK state pension provides average British earners with only 29% of their net earnings from work, compared to the OECD average of 63%.

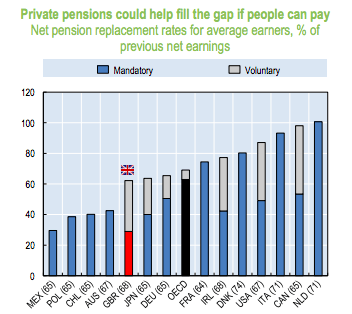

While the study also found that the situation improves if private pensions and savings are included, the increasingly low level of private savings among Brits means that the UK still comes in at seven percentage points below the OECD average of 69%.

And ultimately, what this modest improvement points to is a big gap in pension incomes among retirees, with 18.5% of people above 75 have incomes below the relative poverty line.

Low state pension

Currently, the UK state pension is £159.55 per week, although only if the retiree has made the full 35 years of contributions now required to receive the full amount.

This equals an annual income of £8,296.6, which at approximately only 30% of the median salary (£27,600) is why the UK fared so badly in the OECD's study.

Not only did the UK come last for the difference between the state pension and net earnings of the average worker, but it came fourth from bottom for the difference for low earners (50% of average).

Source: OECD, Pensions at a Glance 2017, Dec 5, 2017

Behind 21 OECD nations

The picture improves when private pensions are included in it, yet even here the UK still fails to reach the OECD average.

Source: OECD, Pensions at a Glance 2017, Dec 5, 2017

In fact, 21 OECD nations still rank above it when private savings are counted, including Germany, Japan, Ireland, France, Denmark, USA, Italy, Canada, and the Netherlands (where pensioners on average receive 100% of their previous work income).

The poverty rate

As the report notes, the fact that not everyone has access to a private pension results in some wide gaps between wealthier and poorer retirees, which itself has some unfortunate implications.

"[R]etirees without such additional sources of revenue are left with few resources", the authors note, "this is reflected in the poverty rate and high income inequality in the United Kingdom for the over 65s".

The report notes that, compared to an average of 11% for the entire UK adult population, 18.5% of over-75s are in relative poverty.

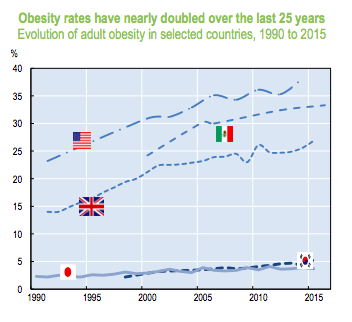

Related to this, the report also found that 20% of over-80s are obese in the UK, compared to 15% in the USA and 10% in Italy, Denmark and Austria.

Source: OECD, Pensions at a Glance 2017, Dec 5, 2017

The savings growth rate

The health risks involved in retirement poverty therefore underline the importance of topping up the meagre UK state pension with private savings, yet unfortunately the current rate of UK savings suggest things might be getting worse.

The growth in savings deposits hit 2.7% in May, after having been 4.8% a year earlier.

The average employee now has only one month's worth of savings to fall back on, which combined with record levels of debt means they're less likely to put sufficient money away in a private or workplace pension.

Increasing inequality

OECD's report darkens this gloomy outlook, however. It explains that despite participation in workplace pensions increasing from 42% in 2012 to 70% in 2015, the pension freedoms introduced in April 2015 may combine with the harsh economic times to cause increasing numbers of people to withdraw their pensions prematurely.

"[R]ecent changes to enable partial lump-sum withdrawals of pensions could increase further inequality as not all will be able to finance retiring earlier", it states.

That said, some analysts blame the UK's poor performance less in terms of economic pressures and the inability to put away as much, but in terms of what pension funds are doing with people's contributions.

Nathan Long, pensions expert at Hargreaves Lansdown, said, "final salary schemes ... have become increasingly short-term and conservative in their strategy", choosing to invest more in bonds rather than in shares.

The retirement cliff edge

Yet regardless of the specific factors that have resulted in the UK's pension system being one of the worst in the developed world, it's clear that it's British workers and retirees who will suffer.

"Working people in Britain face the biggest retirement cliff edge of any developed nation", said Frances O'Grady of the TUC.

Last October, the TUC called on the Government to update workplace pensions so that they offer drawdowns and annuities.

It was argued that such products would offer savers greater security against the possibility of withdrawing pension money in one go, yet to date the Government haven't responded to their proposals with any plans to introduce them.

Get insider tips and the latest offers in our newsletter

Get insider tips and the latest offers in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties