Home > Money > News > Average employee has only one month's savings to live on

Average employee has only one month's savings to live on

LEGAL & General have released a report revealing that the average employee would have only a month's savings to live on if they were lost their job or suffered some other unexpected misfortune.

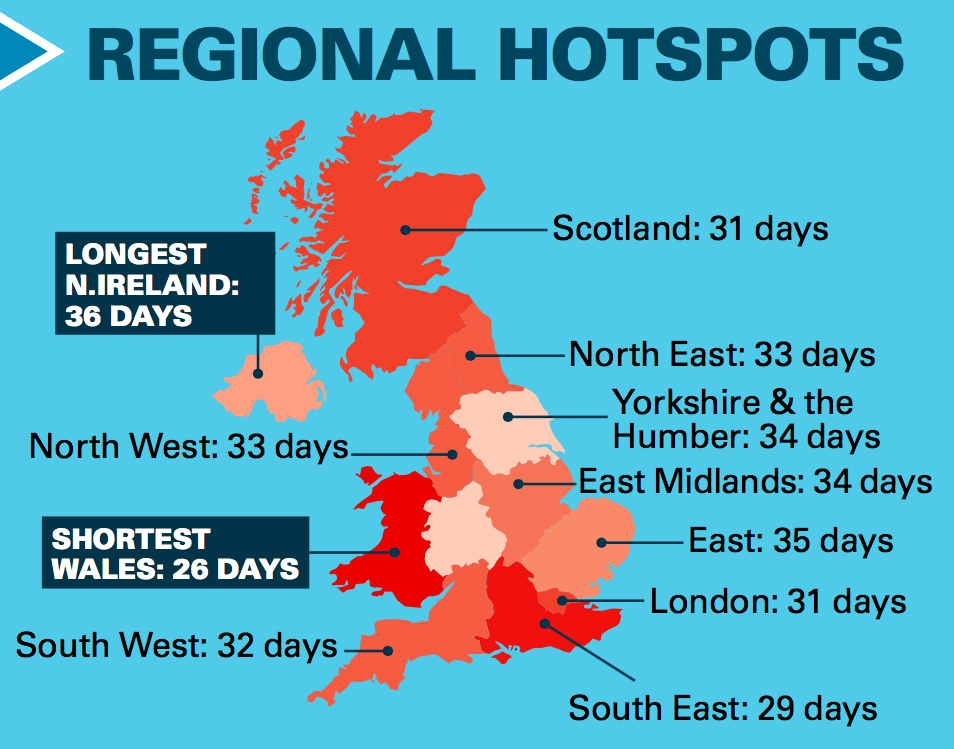

According to their latest "Deadline to the Breadline" survey, employee savings would last for 32 days on average, with this average stretching to 36 days in Northern Ireland and shrinking to only 26 days in Wales.

Worse still, 26% of the survey's 2,000 respondents said their savings would dry up in a week or less, highlighting the serious problems many working households have in making ends meet as living costs rises and wages struggle.

And while it might be suggested that they should try to save more and spend less of their earnings, it's likely that, for many, Legal & General's survey highlights how they simply can't afford to save anything.

The savings and protection gap

Another alarming finding from the report was that, in addition to only 26% of employees not being able to live for more than a week on their savings, 23% of them confessed to not saving anything of their income each month.

That said, the average employee was found to have just over £6,500 in savings, although they also stated that they would need an additional £9,830 to feel sufficiently secure.

However, the situation is better or worse depending on which part of the UK someone lives in, as the following map reveals:

Source: Source: Legal & General, Deadline to the Breadline report 2017

What's also worth pointing out in the map above is that London and the South East are both below the national average of 32 days, even though they're above the national average when it comes to wages.

This highlights how the relatively short "deadline to the breadline" is often about the cost of living and house prices rather than frugality or anything else, with those in more expensive areas feeling greater insecurity.

And it's this lack of security that Legal & General drew most attention to, with their Head of Intermediary Development, Richard Kately, explaining that "the UK still clearly suffers from a savings and protection gap".

He said, "It's important to remember that we all have our own 'deadline the to the breadline' and as this research by Legal & General shows, for some individuals that could worryingly be as short as one week".

Falling wages, rising costs

Yet as can be imagined for a financial services company aiming to sell their own products, Legal & General advised that the solution to this problem involves people taking greater responsibility for their finances and saving more.

On this subject, Kately suggested, "It is vital that individuals and families plan ahead for such a critical event, either by saving money each month to ensure their financial security or by speaking with an adviser about a protection policy that could support them in their time of need".

And yet, while this advice is most likely appropriate for those who have enough money left over each month to save, it likely disregards the fact that the short "Deadline to the Breadline" is largely a product of weak salaries and strong living expenses, not to mention low interest rates.

Inflation, for example, is on the up, with the current rate standing at 2.7%, which is the highest since September 2013. Meanwhile, even though wages had been growing faster than inflation last year, in real terms they were still below those of 2008, while real wages even fell by 0.2% in the three months to March.

Housing

This situation is worsened by the cost of housing, which spent much of 2016 increasing by over 10% annually.

Now, however, housing has in fact begun shrinking in value, with May seeing the first quarterly decline since September 2012, falling by 0.2% between February and April compared to the three months before.

Yet unfortunately for those hoping that this might ease the burden on working families, it should be noted that prices still recorded a 3.8% annual growth, meaning that they were 3.8% higher in April 2017 than they were in April 2016.

And given that they were already fairly expensive in April 2016, it's unlikely that a quarter or two of relative decline is going to make too much difference to most working households, especially when analysts expect prices to remain high in the medium and long term.

It's for this reason that it would be reasonable to expect that, for as long as there aren't enough new houses being built, Legal & General's "Deadline to the Breadline" report will continue showing that even employees are failing to save enough money for the future.

Receive consumer updates that matter in our newsletter

Receive consumer updates that matter in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties