Home > Money > News > House price downturn irrelevant to most first-time buyers

House price downturn irrelevant to most first-time buyers

HALIFAX have reported that the growth in house prices has experienced a marked downturn, with values for the three months to March only 3.8% higher than the same period a year ago.

This compares unfavourably to the 5.1% rate of growth in the three months to February, and even more unfavourably to the 10.1% rate recorded in March 2016.

However, while this might suggest that houses are on the road to becoming cheaper, first-time buyers shouldn't be too optimistic, since 3.8% is still comfortably above wage growth and the rate of inflation.

And because Halifax also report that the supply of houses is continuing to decline, buyers will continue to find the price of the average house moving further from their reaches.

Growth

In fact, one of the most noticeable and worrying trends highlighted in the latest Halifax House Price Index is that the housing market experienced "the 12th successive monthly decline" in the number of new properties entering it.

Halifax note that this is "keeping average stock levels on estate agents' books close to historic lows," which in turn place an additional upwards pressure on prices, even if wider economic conditions mean that demand isn't growing especially quickly.

The last time that there was a growing number of houses on the market was in March 2016, when prices were rising at an astonishing 10.1%.

At the time, the precipitous rise was partly blamed on a 3% stamp duty increase, which was due to come into effect from April 2016 and which many buyers were looking to avoid by purchasing a home before this deadline.

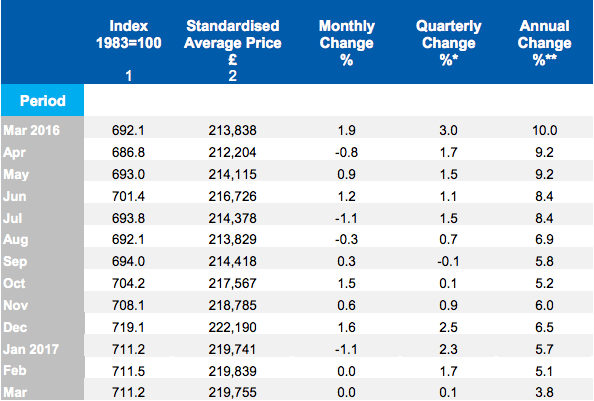

Yet it was also simply an effect of demand far outstripping supply, with prices continuing to rise by sobering amounts even after last April, as the following table makes clear:

Source: Halifax, House Price Index

Continued growth

And even though a slowing to rises of 3.8% suggests that wider economic conditions - including a Brexit-induced drop in consumer spending and stagnant working-age incomes - are putting partial brakes on house price growth, the continuing year-long decline in supply means that prices will continue climbing.

And since 3.8% is well above the 2.2% by which wages grew between January 2016 and Jan 2017, they'll continue growing beyond the ability of many people to afford them.

This is what Halifax's housing economist, Martin Ellis, confirmed when he said, "A lengthy

period of rapid house price growth has made it increasingly difficult for many to purchase a home as income growth has failed to keep up".

Papers and relief cuts

The question, therefore, goes back to the eternal one of what can be done to stimulate supply and build more new homes.

The Government sought to address this recently in their white paper on housing, which outlines simplifications to the planning system and funding help for smaller constructions firms.

However, while their plans will see as many as 425,000 new homes built by 2020 at the earliest, there's little evidence that such numbers will be enough to stop house prices from regularly outpacing wage growth, especially since the UK population is expected to grow by five million people by 2027.

Added to this, another big problem is the existence of buy-to-let landlords, who drive up house prices further by buying up multiple homes.

The Government have also sought to address this problem, this time by introducing the aforementioned stamp duty hike and also by depriving landlords of tax relief worth around 40-45% of annual mortgage repayments.

This removal of tax relief comes into force from this month, and it was estimated that some landlords could end up making losses in as many as 70% of the British towns.

That said, it still remains to be seen whether they'll exit the market in their droves, and whether house prices will fall as a result or at least stop growing so quickly.

The homeowner voting bloc

And while this is still something of an uncertain question to answer, there's at least one fundamental factor which indicates that the growth in house prices will never really fall below inflation and wage rises.

This is the fact that house prices have become so important to homeowners as a source of wealth and retirement income that few if any are likely to support a genuinely radical solution to make house prices fall.

They don't want to see their investments suddenly drop in value, and since they tend to vote in much higher numbers than renters, it's not particularly shrewd of any would-be Government to vow to reduce their collective wealth.

As such, there's every reason to expect house prices to continue rising for the foreseeable future, and for growing classes of people to become even more separated from the prospect of owning their own home.

Receive consumer updates that matter in our newsletter

Receive consumer updates that matter in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties