Home > Money > News > Saving falls as UK economy's reliance on debt grows

Saving falls as UK economy's reliance on debt grows

THE British Bankers' Association (BBA) latest banking data has revealed a decline in personal savings deposits, with annual growth falling to its lowest rate since December 2011.

The annual rate of growth now stands at 2.7% for the 12 months to April 2017, having stood at a healthier 4.8% in the year leading to April 2016.

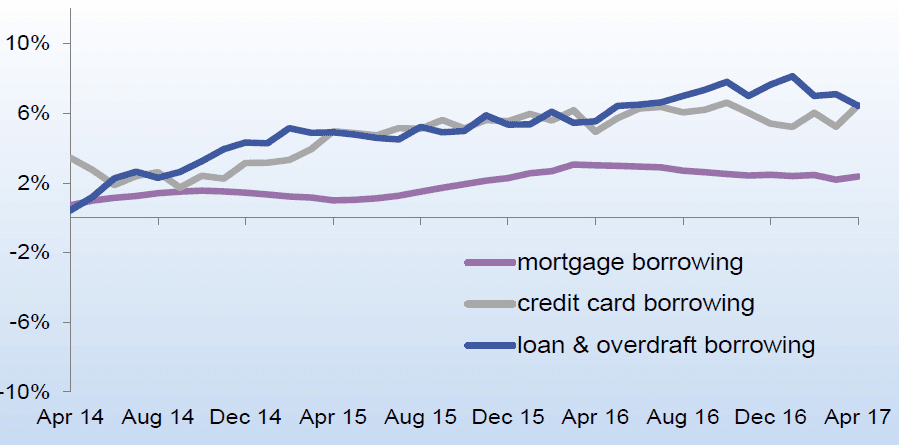

Meanwhile, the rate of growth in consumer credit has increased to 6.4%, after residing at an already high 6.1% in the 12 months to March, indicating that the UK's credit binge is still accelerating.

And at a time when debt-fuelled consumer spending is one of the few things keeping the UK's uncertain economy growing, it's unlikely that this acceleration will be halted anytime soon.

Wages haven't recovered

How does 'Help to Save' work?

We're wrong when it comes to repaying

Insurance fraud rises in tandem with debt

That the debt binge is likely to continue gathering steam has been suggested by a wide variety of organisations, from the Bank of England to the Trades Union Congress (TUC).

Indeed, the TUC warned yesterday that average household debt is likely to grow from the £13,200 recorded at the end of 2016 to £15,400 by the end of 2021, with the trades body suggesting that static wages and rising living costs will be the main cause of this growth.

"We've got this problem because wages haven't recovered," said Frances O'Grady, the TUC's General Secretary. "Credit cards and payday loans are helping to prop up household spending for now, but millions of families are running on empty."

Accordingly, the TUC called on the incoming Government to provide higher wages for employees and public sector workers, a sentiment which has been doubled the Resolution Foundation.

Earlier this month, the think tank's Chief Economist, Matt Whittaker, said, "With pay back in the spotlight and the election rapidly approaching, the parties must use their manifestos to show how they plan to help Britain turn the page on living standards and avoid a new surge in inequality".

Negative ISA growth

The fears contained in such sentiments appear to have been confirmed by the BBA's latest statistics, which showed that the 6.4% rise in consumer borrowing was driven mostly by a rise in credit card debt.

This increased to 6.4%, helped by competition among such banks as Virgin Money, who last month announced plans to grow their consumer lending by 11% by the end of 2017.

At the same time, growth in personal loans and overdrafts decreased from 6.8% to 6.4%, indicating that the rise in household debt is more about day-to-day spending and shopping than the kind of big spending that might require a loan.

Source: BBA, April 2017 figures for the high street banks

And what makes this picture of growing debt more serious is that, at the same time, saving is decreasing, with the growth in personal deposits having been falling since September.

Even worse, the growth of ISA cash deposits is actually negative, with the annual growth rate residing at -2.7%, providing another indication of how households are being forced to eat into their savings in order to make ends meet.

Interest rates

While declining savings are serious enough in their own right, they also point to one of the central issues feeding the rise in debt.

This is the issue of historically low interest rates, which themselves are an indication of the fragile state of the UK economy, which has been struggling to fully recover from the 2008 financial crisis.

The Bank of England's base rate was set at 0.5% in March 2009, and then it was lowered again to 0.25% in August 2016, in the wake of the vote to leave the European Union.

The whole aim of these reductions was precisely to get people saving less and spending more. As the then-Governor of the Bank, Mervyn King, put it, "The Bank of England remains committed to improving liquidity in credit markets that are not functioning normally".

The implications of such a policy is that people spend more on credit and take on more debt, especially at times when wages fail to keep up with the cost of living.

Debt dependent

And at the moment, it's unlikely that the Bank will increase interest rates, not least because the UK economy's growth rate shrank to a very modest 0.2% in the first quarter of 2017.

On the one hand, this slowdown is due to a weakening in consumer spending, yet it's clear that this spending is one of the few things keeping economic growth in a positive balance.

For instance, retail sales volumes grew in April by 2.3% compared to the month before, and were 4% higher than those recorded a year previously.

It's this spending that's helping the UK economy to stay afloat in difficult times, and given that unpredictable Brexit negotiations mean that these times are due to persist for the foreseeable future, it's unlikely that the Bank of England and/or the Government will be willing to act to reduce consumer debt significantly.

That's because the British economy is dependent on this debt, and for all the hand wringing in the press and the political realm about the UK "credit binge", it will remain so until economic growth can be delivered on a more substantial basis.

Get insider tips and the latest offers in our newsletter

Get insider tips and the latest offers in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties