Home > Money > News > Virgin Money lending plans suggest UK credit binge won't end soon

Virgin Money lending plans suggest UK credit binge won't end soon

VIRGIN Money have revealed plans to expand their credit card lending by 11% by the end of 2017, at a time when major UK banks are restricting unsecured lending in response to warnings from the Bank of England.

Summarising their financial results for the first quarter of 2017, Virgin Money reported that their credit card balances currently stand at £2.7 billion, having grown by 8% from £2.5 billion at the start of the year.

Yet in contrast to dire warnings from the Bank of England (BoE) and the Monetary Policy Committee that rising levels of household debt pose a threat to the UK's economic stability, the bank have assured observers that this rise has been achieved via the consistent application of high underwriting standards.

And given that other major banks have even gone so far as tightening their standards this year, it raises the possibility that the dangers of unsecured lending (e.g. credit cards and personal loans) stem less from irresponsible practices on the part of banks, and more from underlying economic factors.

Low and stable cost of risk

In their report, Virgin Money make no mention of risk to the wider British economy, at least not when it comes to their own practices.

Aside from noting that they were the best ranked high street bank for customer satisfaction at the British Bank Awards, they make it clear that the growth in their credit card business has come on the back of scrupulous credit scoring and underwriting.

Their Chief Executive, Jayne-Anne Gadhia, notes, "Whilst maintaining our strong focus on asset quality, credit card balances grew by £0.2 billion to £2.7 billion."

Aside from assuring a high "quality" of debt (e.g. debt that's unlikely not to be paid), she also states, "Our approach, including the strict and consistent application of underwriting standards, continues to support a low and stable cost of risk."

In other words, she feels confident that there's little risk of a major wave of defaults sweeping the bank anytime soon.

Concern

The history of credit

Why was my application rejected?

Your right to reject rate increases

Credit cards: the best rewards

This stands somewhat in contrast to the BoE, whose Financial Policy Committee said in March, "Consumer credit has been growing particularly rapidly. This could principally represent a risk to lenders if accompanied by weaker underwriting standards."

What concerns the BoE is that consumer credit reached an annual growth rate of 10.9% in November, while credit card debt surpassed pre-financial crisis levels by hitting £67.3 billion.

In this context, Virgin Money want to increase the amount of credit they're awarding by 11% by the end of the year, and what's interesting is that this expansion will come at a time when lenders as a whole will be placing tighter restrictions on their lending.

For example, in the BoE's Credit Conditions Survey of lenders for Q1 2017, it was noted that "Credit scoring criteria for granting both credit card and other unsecured loans were reported to have tightened in Q1."

This means that banks are requiring customers to fulfil more conditions before granting them credit cards or unsecured loans. However, even with this reinforcement of underwriting, Virgin Money's declaration of intended expansion indicates that competition between banks over consumer credit is likely to remain fierce and to continue increasing.

Competition and growth

This isn't suggested only by the glut of 0% purchase and balance transfer cards that were launched at the end of last year, but also by certain responses given by lenders to the Credit Conditions Survey.

Even though banks reported that they plan to make credit scoring criteria more stringent in the second quarter of 2017, they also reported their expectation that "the proportion of credit card applications being approved" will grow a little compared to the previous three months (the net percentage balance in favour of overall industry growth was 3.1%).

This expectation is also backed up by forecasts from the Office for Budget Responsibility, who in November estimated that the household-debt-to-income ratio would rise from its current 143.9% to 149% by 2022, coming close to the 160% peak reached in 2008.

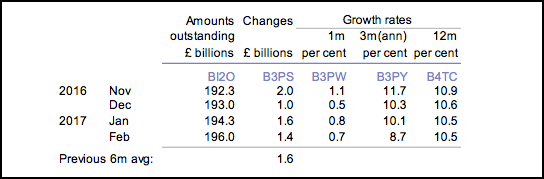

And finally, it's also supported by the BoE's latest Statistical Release, which found that consumer credit was still increasing at 10.5% in February, as the table below indicates.

Source: Bank of England, Statistical Release March 2017

Growth in credit card borrowing will therefore continue to increase for the foreseeable future, even though banks will be making their underwriting more robust. And if nothing else, this undercuts any notion that it's the laziness of credit scoring methods that's putting the UK economy at risk.

The economy, stupid

Instead, it's the current structure of the UK economy itself that's causing a surge in borrowing, and that's leaving the financial system vulnerable to a sudden shock.

Because of historically low interest rates, credit has become considerably more affordable in recent years. As such, even the use of high underwriting standards can't stop it from being within the reach of a larger number of people than ever before, not least because competition means many banks are offering 0% interest for as many as 43 months.

Added to this, the sluggishness of working-age incomes means that the increasing number of employed people are likely to apply for credit, especially if inflation remains at 2.3% or climbs higher.

And together, these factors all conspire to increase credit card borrowing, as Virgin Money appear to be well aware of when they forecast an expansion in lending at the same time as maintaining their "strict" underwriting standards.

Get insider tips and the latest offers in our newsletter

Get insider tips and the latest offers in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties