Home > Money > News > Decline in buy-to-let not enough to slow housing market

Decline in buy-to-let not enough to slow housing market

THE Council of Mortgage Lenders (CML) have reported that buy-to-let sales of homes have fallen by almost half over the past year, decreasing to an average of 6,000 purchases a month.

The dramatic fall has come after changes to tax relief and stamp duty made it more expensive for buy-to-let landlords to purchase second homes, with the CML revising down their buy-to-let forecasts for 2017 and 2018 by a total of £8 billion as a result.

And at a time when the number of first-time buyers have increased by 8% compared to last year, such news of a buy-to-let downturn might suggest that the recently struggling housing market will continue becoming more friendly to younger homebuyers.

However, given that many sellers have responded to the recent slowdown in house price growth by essentially taking their homes off the market, it's likely that the decline in landlords won't be enough to bring a much-needed longer term decline in house prices.

A weak start

Price gap shows big London bias

Supermarkets add £22,000 to homes

Are homes a better bet than pensions?

Still, the drop in buy-to-let lending is certainly easing the pressure that many first-time buyers were experiencing prior to the changes in tax relief and stamp duty.

As the CML note, "Buy-to-let had a weak start to 2017, and the sector's contribution to overall net mortgage lending has fallen considerably over the last year".

They admit that they had expected a "slight recovery in lending levels" after the introduction last April of a 3% stamp duty surcharge for buy-to-let buyers, but "that has not materialised".

Instead, buy-to-let mortgage numbers have remained at lowered levels, and the CML suggest that it may have begun declining further after this April, when landlords who pay the higher rate of tax began seeing a gradual reduction in the tax relief they can receive on mortgage interest every year.

They wrote that this change "will make landlords more cautious and is likely to restrict their ability to re-leverage their portfolios".

By "the ability to re-leverage", CML are here referring to the ability of landlords to borrow extra money against the value of the properties they rent out. Given that they'll receive less tax relief, it will become more expensive for them, and may indeed put some off of purchasing buy-to-let properties altogether.

In light of this possibility, they've downgraded their predictions for buy-to-let mortgage lending in 2017 and 2018. Instead of £38 billion for both years, they're now forecasting £35 billion and £33 billion respectively, suggesting a gradual decline.

No major decline

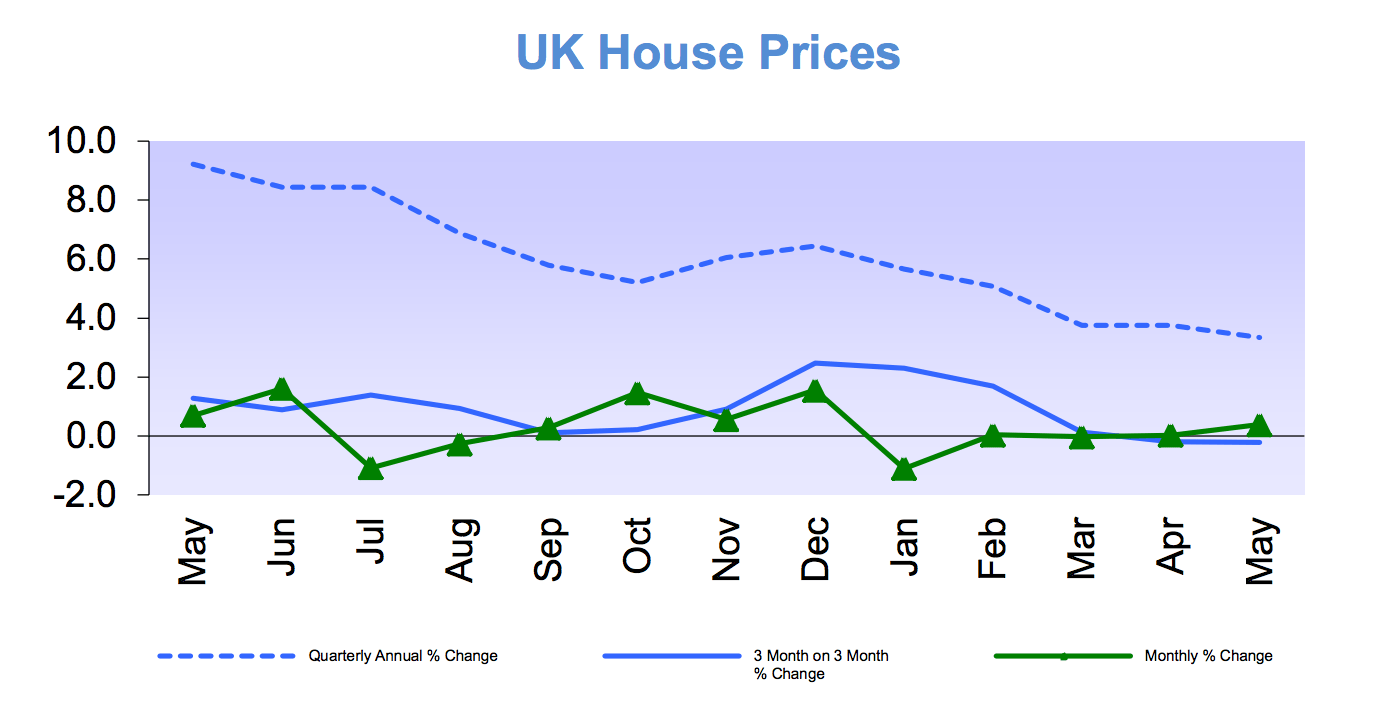

In combination with the recent deceleration in house price growth, as well as the 0.2% drop in prices between February and April, it might be assumed that this gradual decline in buy-to-let would translate into a gradual decline in house prices.

Unfortunately, this scenario seems unlikely at the moment, if only because house prices began rising again last month after their momentary lull.

They grew by 0.4%, and while this is hardly the most astronomical rise ever recorded, certain other indicators suggest they'll stay at around the same level in the coming months as well.

Source: Halifax, House Price Index, June 2017

For one, the CML's report noted how the number of movers (i.e. second- or nth-time buyers) has fallen by 9% compared to a year ago, something which "naturally limits the number of properties that come up for sale".

As such, even though demand is low relative to previous months and years, supply is even lower, thereby ensuring that prices remain more or less where they are.

That the market is essentially stable despite recent wobbles was also indicated by another element in CML's report, which was that the value of gross mortgage lending has continued to rise.

It rose to £20.1 billion in May, representing a 12% increase against both the previous month and the previous May.

Much of this increase was driven by an increase in remortgaging, which on the one hand means that the owners aren't putting their homes up for sale. On the other, it also often means that more money is being borrowed against the homes, which generally implies that more will have to be paid for them in the event that their owners end up moving.

Because of this, house prices aren't likely to descend in any substantial way in the near future, although they may continue wavering uncertainly or even declining very slightly in the short to medium term.

More first-time buyers

Nonetheless, even if house prices aren't going to become decidedly affordable anytime soon, the reduction in buy-to-let lending is good news for first-time buyers, who increased by 8% over the last 12 months.

Without the apparent disappearance of certain landlords, they'd face greater competitions for housing, which would become more expensive as a result.

It can therefore only be hoped that the CML's predictions of a continued decline in buy-to-let lending will be found true, and that at least a few more people can enjoy home ownership, even though it will still remain out of the grasp of many of the UK's four million plus renters.

Receive consumer updates that matter in our newsletter

Receive consumer updates that matter in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties