Home > Money > News > Homes close to big supermarket cost £22,000 extra

Homes close to big supermarket cost £22,000 extra

NEW research from Lloyds Bank has found that properties within convenient reach of a supermarket are, on average, £21,512 more expensive than those further afield.

More interestingly, the research revealed that certain supermarket brands command a greater premium than others, with a nearby Waitrose, Marks and Spencer, or Sainsbury's adding the most to a home's value.

Waitrose, in particular, is associated with a £36,480 increase in value, yet it's just as likely that the "direction of causality" is the other way around in many cases, with Waitrose choosing to locate their branches in more affluent areas where homes are already more costly.

Still, regardless of this direction, the study nonetheless highlights one of the major causes of the housing crisis, which is that people are almost inevitably driven to crowd into more densely populated areas where there are more amenities.

The £22,000 convenience

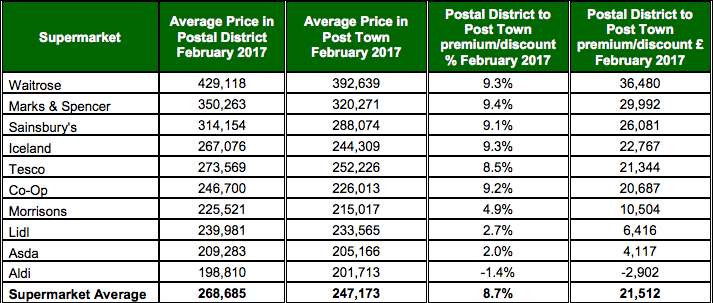

For their research, Lloyds included all 10 of the UK's major supermarkets, as shown in the table below:

Source: Lloyds Bank

Excepting Aldi, all of them currently add a premium to average house prices, with four chains in particular - Waitrose, Marks & Spencer, Sainsbury's, and Iceland - adding premiums above the average for all supermarkets.

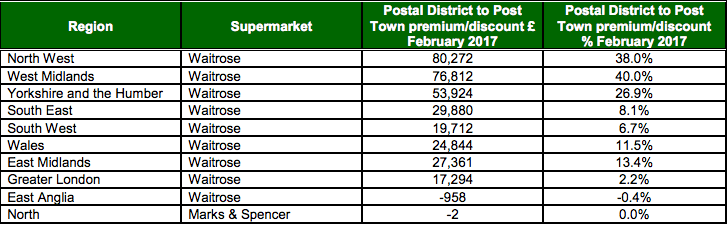

Yet Lloyds note that their boosting effects are more pronounced in certain areas of England and Wales. In the North West and the West Midlands, in particular, a nearby Waitrose means that a house can expect to be worth 38% and 40% more than average.

Source: Lloyds Bank

Because of such pronounced effects, Lloyds' mortgages director, Andy Mason, said, "With homes in areas close to major supermarkets commanding a premium of £22,000, the

convenience of doing weekly shopping within easy reach may well be a pull for many homebuyers looking for good access to local amenities".

'Budget' supermarkets

Housing problem needs more than Gov fund

Bank of England warn of household debt

Homes 'failing' because of high prices

This is perhaps the study's major conclusion, yet one other interesting finding is that areas close to more "budget" supermarkets have seen the biggest increases in value in percentage terms.

Since 2014, for example, the values of homes close to an Aldi, Lidl, Morrison's or Asda have risen by 11% on average, whereas the values of homes close to any of the UK's supermarkets have increased by only 9%.

This 11% rise is even higher than the 10% for all homes in England and Wales, yet what makes it even more impressive is that, in 2014, the average property near a Lidl was £4,719 cheaper than the national average.

Now, it's £6,416 more expensive, highlighting not just Lidl's growing fortunes as a brand, but also how such supermarkets have arguably played a role in developing areas that were once relatively neglected.

Correlation rather than cause

Yet the fact that such shops as Lidl were and generally are to be found in poorer areas highlights how supermarkets tend to locate themselves close to their desired markets and customer bases.

In other words, "posher" supermarkets such as Waitrose and Marks & Spencer tend to focus on more affluent areas, while budget names such as Lidl and Aldi usually go for their less affluent counterparts.

To a large extent, this would explain why Waitrose and M&S provide the two highest premiums, since they make it a habit of siting their stores in more well-off areas, where the kind of people they brand themselves to live.

In fact, the Lloyds' research acknowledges this to some extent, insofar as it explained the rise in Lidl's "premium" in terms of Lidl choosing to move to more well-to-do areas.

On this point, Andy Mason said, ""There has been some suggestion that the likes of Lidl and Aldi are increasingly locating in more affluent areas where prices are already relatively high".

As such, it begins to seem that the "supermarket premium" may not be so much a cause of higher house prices as a correlation, in that supermarkets will tend to go wherever the highest number of relevant customers are.

Preferring crowds

Yet in highlighting this tendency, the research also highlights a major factor in the current housing crisis.

Namely, it underlines how, regardless of whether cheaper houses could be built on the outskirts of towns, people will always prefer living in more densely packed centres where there are the most attractions and amenities, such as supermarkets.

That people are prepared to pay more to live in such centres creates a disincentive against building cheaper houses elsewhere, since building firms unsurprisingly want to build the kind of expensive homes that will maximise their profits.

Because of this, the UK is left in the situation it is now, where houses earn more than workers and where prices still show an annual above-inflation increase of 3.8%, despite experiencing a monthly fall for the first time since 2012.

And what Lloyds' research reveals above all else is that, despite Government efforts to the contrary, our desire to live as close to each other as possible will always exert an upwards pressure on house prices.

Receive consumer updates that matter in our newsletter

Receive consumer updates that matter in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties