Home > Money > News > Triodos announce ethical current account

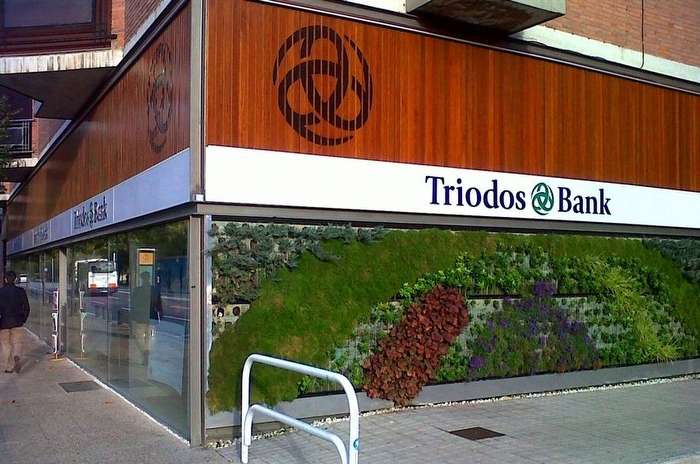

Triodos announce ethical current account

TRIODOS are to launch their first ever UK current account, aiming to provide a more ethical alternative to the current accounts offered by the big high street banks.

The Dutch bank - who have been operating in the UK for 22 years - will be giving the online only account a phased rollout from this June, when it will be offering 0% interest to customers with a £3 monthly fee.

While this might make it seem unattractive compared to accounts that offer as much as 3% or even 5% interest (for a limited time), Triodos affirm that they lend only to companies that make a positive contribution to society. Not only that, but they vow not to hit customers with unexpected and steep fees for unarranged overdrafts, which aren't permitted by the account.

Whether this will be enough to entice customers to open an account with them is another matter altogether, yet it's clear that their new launch represents a genuine attempt to offer an alternative to the deceptive "free" banking culture that currently dominates in the UK.

No such thing as a free lunch

What to look for in a current account

Can £100 make you move account?

Is your bank ethical?

As their Head of Retail Banking, Huw Davies, says, "There is no such thing as 'free' banking because someone else always pays."

He goes on to point out that "'Free' accounts are usually subsidised with high penalty charges and hidden fees, so the most vulnerable customers ... end up paying an exorbitant price."

For the most part, when he and Triodos refer to "high penalty charges" they're referring to unarranged overdraft fees, which can sometimes be 12 times more expensive than those for payday loans.

Such expense can put some customers under considerable financial strain, which is why Triodos have decided on a model that's financed in a much more upfront way.

They will be allowing arranged overdrafts of up to £2000 upon request, but otherwise their services will be relatively streamlined, with a monthly £3 fee and no interest.

This may not be particularly sexy, yet it's arguably more honest, and perhaps Triodos are hoping it helps stimulate an appetite for more transparent retail banking.

Ethical investments

In this endeavour they'll be helped by their own operations and ethos as an investment bank, seeing as how they promise to lend only to "organisations and projects that are making a positive difference to society, be it socially, culturally or environmentally."

In fact, any customer who takes out a current account with them will be able to check up on every single loan the bank make via their website, www.knowwhereyourmoneygoes.co.uk.

Given that this is something a Barclays or RBS aren't likely to do anytime soon, it will potentially distinguish the bank and help it to fill the partial vacuum left by the troubles the Co-operative Bank have been facing in recent years.

And on top of its upfront fee model and ethical investments, Triodos' current account will also come with the following features:

- Eco-friendly Triodos MasterCard debit card made of "natural" plastic

- Internet banking and mobile banking, with text alerts to help customers manage their account

- Cash withdrawals of up to £300 from any ATMs in the world that accepts MasterCard and LINK

- Authorised overdraft limit of up to £2000 by request, subject to status and with a rate of 18% EAR

- Membership of the "Triodos community", granting access to special events and a network of "inspiring organisations"

Even with these perks, however, the question remains as to whether customers will be willing to jump ship from bigger, less ethical banks, especially when only 3% of current account customers switched account in 2015/16.

Still, Triodos' account is a refreshing alternative, and at a time when the Co-operative Bank's potential sale is putting ethical banking at risk, it's needed now more than ever.

Receive consumer updates that matter in our newsletter

Receive consumer updates that matter in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties