Home > Money > News > Co-op bank crisis deepens: time to move away?

Co-op bank crisis deepens: time to move away?

THIS has been a sad week to be a Co-operative Bank customer.

On Monday, the bank delayed the release of their financial results, due to be published on Tuesday, for a second time.

On Thursday, Lord Myners, who joined Co-op at the end of last year to reorganise the mutual, resigned and so did the group's chief information officer.

Both follow the chief executive of the Co-operative Group Euan Sutherland, who resigned just two weeks ago after details of his £3 million a year pay package were leaked to a newspaper.

Today, Co-op finally released their results, revealing a pre-tax loss of £1.3 billion for the year.

Time to move?

The week's intense chaos at the Co-op won't surprise customers - after the initial shock of the early 2013 downgrade and then the Paul Flowers revelations at the end of last year, that would take a lot - but it does make clear that the bank is still very far from recovery.

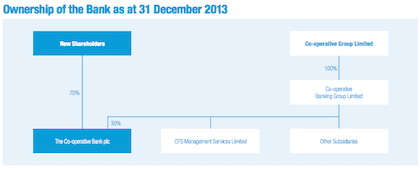

Today's results raise new questions about how much power the Co-operative Group, which still owns 30% of the bank, will have over the future direction of the organisation.

Of particular interest to many Co-op customers will be any changes, or even potential changes, to the bank's ethical policy, which has set it apart in recent years.

For many customers, the issue of high pay for executives at the top of the bank is also a pressing concern.

A divided co-operative

Lord Myners' report suggests drastically changing the way that the Co-operative Bank is run.

Currently, the Co-operative Bank has three levels of governance, area committees representing the group's eight million members on the bottom level then there are regional boards and, finally, a group board of which 75% of members are regional directors.

Myners argues that this system has led to poorly qualified people getting top jobs. He wants to set up a board that's more like a public company and then keep the members council separate.

Unsurprisingly, that idea has gone down like a tonne of bricks with many Co-op employees who the proposal as chipping away at the unique nature of the bank, it would mean that members wouldn't get a direct vote on the boards, and allowing management to become less accountable to members.

Myners says that, on the contrary, the current set up gives members very little real say, especially as the group only controls 30% of the bank.

SOURCE: the Co-operative Bank annual report 2013/14.

Members are insecure, however, and only likely to grow more so.

Today the bank confirmed that it is raising £400 million to cover past losses which, if the bank created new shareholders, could dilute the power of members even further.

All in all, there's a real fear of members losing control of the bank and of key policies like its commitment to ethical banking.

Ethical banking staying

However, based on today's report the Co-op won't drop their ethical policies in the near future.

"We believe that it is important that we maintain our differentiated characteristics and ethos, continuing to adhere to the values of the wider Co-operative Movement under our new ownership structure," the report says.

Co-op will renew their ethical policy in the coming months but many remain upbeat about the impact.

For example, Rob Harrison of Ethical Consumer said last year that Co-op shouldn't be judged on its poor decisions.

"Sure, the Co-op's taken a reputational hit but things didn't go wrong because of its ethics, they went wrong because of a bad business decision to buy the Britannia Building Society," he said.

Executive pay

A bigger issue for those considering leaving the bank is likely to be executive pay.

The Save Our Bank campaign, a lobby group of Co-op customers pushing for the bank to keep its strong ethics and eventually return to mutual ownership, is calling on top bosses not to take bonuses.

The new chief executive has been promised a £1.7 million bonus if the bank's position improves.

"The bank needs to take a lead and show that it is different," said Shaun Fensom from the Save Our Bank campaign today.

"It can start by rejecting excessive pay deals.".

Receive consumer updates that matter in our newsletter

Receive consumer updates that matter in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties