Home > Money > News > Labour vow to cap credit card debt

Labour vow to cap credit card debt

LABOUR have called for a cap on the amount of interest customers can be charged on credit card debt, limiting the total amount of payable interest to 100% of the amount originally borrowed.

Being promised by the party in the event they come to power, the cap would act in much the same way as that imposed in 2015 by the Financial Conduct Authority (FCA) on payday loans, which can have a daily interest rate of no more than 0.8% and can charge total interest of no more than what the principal loan amount was worth.

Labour claim that doing much the same thing for credit card debt would protect the approximately three million people in "persistent debt", in which borrowers pay more in charges and interest than they pay of their original sum.

However, lenders have argued that capping charges would discourage banks from lending to customers via credit cards, which in turn would might push customers towards unregulated, "black market" lenders.

Growth

Why card applications get rejected

A look at how we're handling debt

Can credit card debt be wiped?

Debt has been an increasingly serious problem as of late, with consumer credit/debt growing by 10.9% in the 12 months to November 2016: the fastest rate since 2005.

Such growth has led to commentators suggesting that a "credit binge" is currently under way, with the Bank of England in particular warning lenders and the public in general that household debt is growing too fast.

It's because of this climate - in which personal insolvencies rose by as much as 13% in 2016, for example - that Labour are proposing a change to the law surrounding credit card lending and debt.

Their Shadow Chancellor, John McDonnell, is due to give a speech at the party's conference in Brighton this week.

In it, he will suggest a "total cost cap", which would ensure no credit cardholder would have to pay more in interest that what they spend on their card.

For example, if a customer spends £1,000 on their credit card, then the cap would mean that the interest they owe on this debt could rise to no more than £1,000, making for a total debt of £2,000.

This is essentially the system that now prevails for payday loans, with McDonnell set to say, "I am calling upon the Government to act now apply the same rules on payday loans to credit card debt. It means that no-one will ever pay more in interest than their original loan".

By applying such rules, it's believed that people will be saved from entering a downward spiral of persistent debt, and that lenders will be spared from masses of customers having to default in the case of an economic downturn.

Dangers

However, as real as the problems of persistent debt and high household borrowing are, there are some who believe a cap on interest and charges would only make the situation worse.

UK Finance - who represent the financial industry - believe that such a cap would reduce the supply of credit cards offering generous rates and deals, with this reduction having unfortunate effects on the economy and on people who need to borrow.

Their spokesperson said, "the last thing the industry wants is to see those who are most vulnerable being pushed towards the hands of unscrupulous and unregulated lenders".

While there's little doubt that the banks they represent want to maximise their profits, they do have a point here, since the example of payday loans suggests that some customers may be driven by a cap into the wrong hands.

For instance, in July 2015 the Consumer Finance Association (CFA) published a report which found that, in the wake of the rule changes, 4% of the people rejected for a payday loan ended up going to a loan shark.

Such findings are particularly worrying, and suggest that even if a cap on credit card charges solves many problems, it may perhaps cause a few of its own.

It's the economy

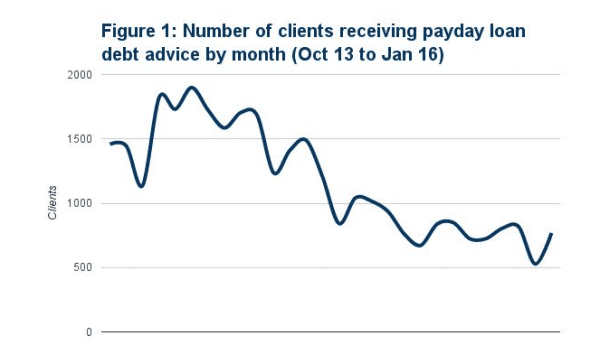

However, given that Citizens Advice, for example, witnessed an 86% decrease between 2013 and 2016 in people contacting them regarding payday loans, suggesting that the benefits may far outweigh the disadvantages.

Source: Citizens Advice, Payday loans after the cap: are consumers getting a better deal? August 2016

And while a small percentage of people may be forced to certain unsafe and unregulated lenders, the most effective and beneficial way of reducing this risk would be not by avoiding the cap altogether, but by improving the economy.

By reducing the high rate of inflation and by helping wage growth, for example, people would not only be less likely to need to turn to loan sharks, but they would be much less likely to need to rack up credit card debt altogether.

And in an economy that's seen such debt mounting up to pre-crisis levels, this could only be a good thing.

Get insider tips and the latest offers in our newsletter

Get insider tips and the latest offers in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties