Home > Money > News > Insurers warn Tax rise hurts 'just about managing' families

Insurers warn Tax rise hurts 'just about managing' families

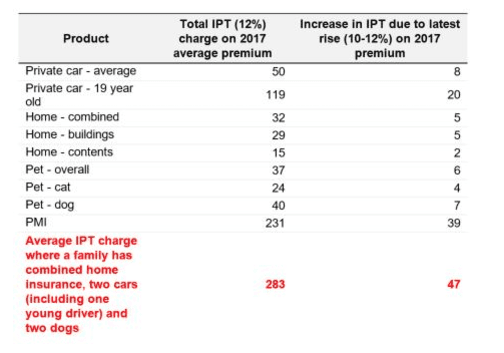

THE Association of British Insurers (ABI) have warned that the latest rise of the Insurance Premium Tax from 10% to 12% "heaps more pressure on 'just about managing' families", adding £47 to the average annual household insurance bill.

The rise comes into effect from June 1st, only eight months after it rose to 10%, and only two years after it rose from 6% to 9.5%.

With the additional 2%, the "average" motorist will pay an extra £8 a year for their car insurance, while the average 19-year-old will pay an extra £20 a year.

And given that these increases come at a time when premiums are already rising at around 4.9% every quarter, it's likely that the Government's use of insurance as a cash cow may keep some potential motorists off the road.

Mounting costs

One million uninsured drivers in the UK

AA blame rises on whiplash and switching

Facebook stop Admiral from using data

While the addition of an extra £47 to the average household insurance bill is already significant enough for the UK's 6 million "just about managing" families, what's striking about the ABI's figures is that, at 12%, the Insurance Premium Tax (IPT) now adds £283 as a whole to the typical insurance bill.

As the ABI also note, what makes the latest rise worse is that it follows the Government's recent decision to lower the discount rate from 2.5% to -0.75%.

With this cut, insurers will have to pay out more in compensation to insurance claimants, a change that some analysts predict could add as much as an extra £1,000 to the premiums of younger drivers.

And it's precisely because costs are already stacking up for drivers that the ABI have said the "latest rise comes at the worst possible time".

As the table below shows, it adds the following to the "typical" household insurance bill:

Source: Association of British Insurers

It's because it piles further costs on already ballooning premiums that the ABI have called for a halt to any further increases, asserting that the "latest hike must be the last".

Their Director of General Insurance Policy, James Dalton, said, "With a doubling of IPT in just under two years it is time to call a halt to this raid on the responsible. This tax penalises hard working families ... who have done the right thing by taking out insurance to protect against many of life's uncertainties."

Decline in younger drivers

Yet the ABI perhaps don't go far enough, since the latest increase won't simply "penalise" families, but will make it likelier that some people are prohibited from driving altogether.

For example, in the Department of Transport's most recent National Travel Survey, it was reported that the "proportion of young adults (aged 17-20) with a full driving licence has decreased since the 1990s when it was highest for this age group".

In 1993, this proportion stood at about 52%, yet since then it's steadily decreased, standing just below 40% in 2015.

A similar trend can be observed for people aged between 21 and 29, with about 84% of men holding a licence in 1993, and just under 70% holding one in 2012.

And for those who choose not to pursue a licence, the Department of Transport noted in their survey that 43% of "17-20 year olds without driving licences cite cost of learning to drive or cost of insurance as main reason for not learning to drive".

Likewise, Autotrader and the driving school RED revealed last year that they'd recorded a 21% decline over the past nine years in the number of 17-to-20 year olds taking the driving test, a drop that was blamed in part on increases in insurance costs.

Physical and social mobility

This decline is perhaps worrying enough on its own, yet what makes it more concerning is that a decline in mobility is often linked to a decline in social mobility.

In areas where there isn't adequate public transport, for example, people who lack cars often find it more difficult to find employment, something which distinctly hampers their chances in life.

This is what an influential study published in the Journal of Transport Geography suggested in 2002, with the authors stating, "For people with constrained physical mobility, the viability of accessing many opportunities and services is severely reduced".

In much the same vein, a 2014 review of the literature on "transport poverty" concluded that reduced access to transport "can exacerbate poverty by reducing access to key services such as employment, education and healthcare, lead to social isolation and reduce physical and mental well-being".

It's precisely because reduced physical mobility has such an effect on social mobility that the latest increase to the IPT will be bad news for many people.

It will make it harder for them to drive and harder for them to move up in life, just when the Government has promised to establish Britain as the world's "Great Meritocracy".

Get insider tips and the latest offers in our newsletter

Get insider tips and the latest offers in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

24 August 2022

Home insurance premiums fall in latest ABI figures