Home > Money > News > Insurance costs not clear enough

Insurance costs not clear enough

INSURANCE companies and those selling their products don't make the cost of paying by instalments clear enough, the Financial Conduct Authority (FCA) have said.

The FCA's report says that around half of us choose to pay for our home or car insurance by monthly instalment rather than upfront, but many people don't realise there can be a significant difference in price between the two.

In fact, the FCA's research revealed some instalment plans come with interest rates of as high as 75% - as well as credit broking fees.

On this point, the FCA also said that when firms were arranging credit for customers, it often wasn't clear enough what their role or costs were.

They say these issues could mean competition isn't effective - and that customers aren't getting good or fair deals when buying insurance.

Annual versus monthly payment

The FCA looked at the process of buying insurance through 43 different sellers - including 13 insurers, four price comparison sites and 29 other "insurance intermediaries".

They went through the online policy-buying process as far as the point where a customer would be expected to enter payment details - and found that 19 of the sites they tested didn't reveal the difference in price between paying upfront and paying by instalment.

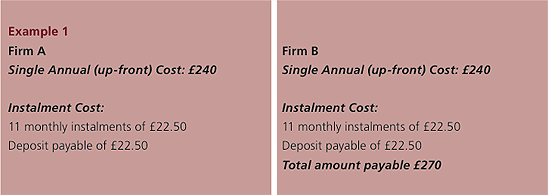

The most common way of obscuring the difference in cost is to provide two options, one showing the total one-off price, and one showing the price of each payment and how many there'll be, plus any deposit - but with no grand total.

It's worth bearing in mind that only 19 sites obscured the cost like Firm A in the FCA's example:

SOURCE: FCA, Provision of premium finance to retail general insurance customers, May 2015

The other 24 did show the total cost of paying by each method at some point in the initial stage of the process, if not in the same way as Firm B in the example above.

APRs and other charges

But there were also concerns about how the interest and any fees payable were explained.

On nine sites, anyone wanting to pay by instalment had to pay an additional fee in order to access that option - but three of those sites didn't say how much that fee was.

Additionally, the nine sites that charged fees for providing an instalment facility tended to be acting as credit brokers - but they didn't always make that clear, or that it was them levying the fee rather than the insurer.

FCA rules state that sites offering credit must provide a "representative example" containing all of the following information, with no one part being missed out or emphasised:

- Whether there are any charges that aren't as a result of interest - set-up fees, for example

- What the annual interest rate is, and whether it's fixed or variable

- The representative APR

- Any advance payments, and how much they are

- The cash price

- The duration of the credit agreement

- The total amount of credit required

- The total amount payable during the agreement

- How much each payment will be

That's a lot of information to get in, and most sites the FCA looked at failed in some way - from not displaying the interest rate, to not showing the cash price, to giving one part of the information more prominence than the rest.

The cost of each instalment was emphasised by 12 sites, which the FCA say runs the risk of distracting customers from the full cost of the policy by giving them a much more attractive, smaller, figure to focus on.

This isn't uncommon - think of the tactics of catalogue and rent-to-buy companies offering goods for small weekly sums that add up to far more than they'd usually cost.

Then there's the small - or not - matter of how much interest the companies charged.

More than half didn't say what their interest rate was, while four sites offering credit didn't include an APR, which the FCA say is crucial in allowing customers to compare products.

Consider that only four sites offered APRs of less than 20%, half had APRs between 26% and 40%, and one had an APR of more than 75%. Customers looking at similarly priced policies could well end up paying vastly differing sums for their coverage.

But there's also the matter of how the credit brokers in the study were operating in general.

Since January they've faced much stricter rules - but the focus has mostly been on those acting as lead generators for loans rather than intermediaries for insurance companies.

To further complicate matters, the FCA say more than three quarters of the "brokers" they looked at in this study appeared not to offer any alternative finance plans.

That, they suggest, means the site was working exclusively with particular lenders rather than acting as a true credit broker.

In any case, the regulator says the relationships between the sites, lenders and insurance companies must be made far clearer.

Flicking through versus clicking away

As well as knowing exactly how much a policy will cost us, the FCA requires companies offering credit as a means of payment to provide us with specific information and explanations.

But of the 38 sites appearing to be offering credit, 31 didn't provide pre-contract information in the correct format.

Only 13 provided what the FCA considered to be an "adequate explanation" of the proposed credit agreement - including any risks and the consequences of non-payment.

Sites are also supposed to provide that "adequate explanation" in the form of a set of screens or pages that the customer must click through during the purchase process, so everyone buying via instalment gets to see them somehow.

But several sites only offered customers a link to other pages containing the relevant information, meaning they could bypass them entirely.

What's being done?

Taken all together, the above has given rise to serious concerns that insurers, their agents, and other intermediaries aren't fully complying with regulations.

So the FCA say they're planning to "engage with" the industry on a wider level, and with individual firms.

They've also raised the possibility of more serious, disciplinary, action for those companies shown to have particularly poor practice or possible failings.

Get insider tips and the latest offers in our newsletter

Get insider tips and the latest offers in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties