Home > Money > News > Is free banking on the way out?

Is free banking on the way out?

Free banking isn't sustainable and will be non-existent within 10 years, according to a report from PricewaterhouseCooper (PWC).

The report also suggests that free banking is partly to blame for some of the mis-selling scandals of recent years, and warns that it could make the issue worse in the future.

But while most people acknowledge that free banking isn't actually free, about half say they'd change banks if their institution introduced upfront fees for their services.

And while they seem to be the model for accounts people are willing to pay for, PWC say packaged accounts aren't the solution, despite offering visible extras for the monthly fee.

Odd tradition

Free banking as we know it is actually quite unusual, and it's a fairly recent innovation, dating back only to the 1980s.

It was Midland Bank (now HSBC) who began the revolution when, in 1984, they began offering "free banking for as long as you stay in credit".

Within a few months, the other UK banks had followed suit.

But on the Continent, people expect to pay for their current accounts - in 2012 the average fee was £70 a year, around £5.80 a month.

Customers understand that fee covers the cost of staffing branches and maintaining basic services - not providing extras like insurance or cashback.

In the UK, however, more than two thirds of people say they know their free banking isn't actually free - thanks to fees and interest on their overdrafts, charges for missed payments, and almost non-existent interest when they're in credit.

And only 20% of those questioned said they'd be willing to pay a set monthly or annual fee to avoid these charges or get a better return, and one in two said they'd be likely to switch banks if theirs brought in an upfront fee.

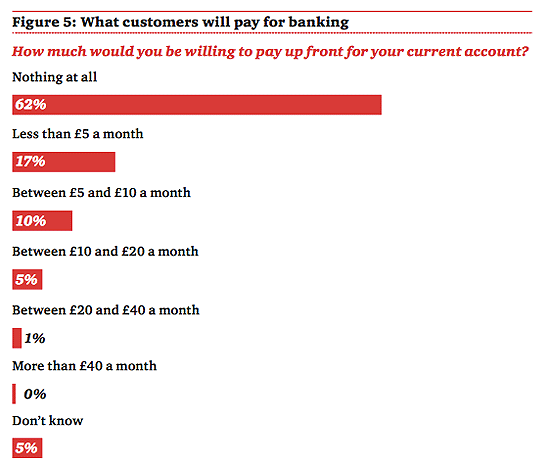

Almost two thirds of people said they wouldn't pay anything upfront for a current account, and a further 17% said they'd only pay up to £5 a month.

Only 10% of people said they'd be willing to pay between £5 and £10 a month - roughly on a par with what our European counterparts pay.

SOURCE: PWC, No free lunch - Why fees are the future for current accounts, January 2015.

What will we pay for?

PWC say that as the majority of people aren't willing to pay anything for their current account, they're highly unlikely to move to a packaged account where "part of the charge explicitly represents the cost of the basic service".

So they asked: if people did have to pay for their current account, what services would they want included?

The top three responses were cash back on household bills (44%), free overdraft facilities and a better, fixed, rate of interest over the life of the account (both scoring 38%).

Travel insurance and breakdown cover - two staples of the packaged account - were of interest to just under a quarter of people, while 21% of people said they'd like commission-free transactions when abroad.

The least popular options were mobile phone insurance (16%) and preferential discounts on shopping and entertainment (14%).

Apart from getting cashback for doing what most of us have to do every month, there's no one service or perk that most would agree to pay for, even just good service.

It's working out what services to offer, and how useful they are, that has caused the packaged account mis-selling problem.

Competition

Another issue cited by those calling for an end to free banking is that it stifles competition and removes transparency.

Earlier this month Virgin Money chief executive Jayne-Anne Gadhia told the Financial Times customers don't switch accounts "enough" because they don't see any difference between the various products on offer.

She has a point, and performance reports since the launch of the Current Account Switch Guarantee also agree - at first glance all the current accounts on offer appear the same.

They're not, of course - with different fees and interest charges for overdrafts, different interest rates for in-credit balances, and so on - but it's difficult for customers to see that quickly and easily, and therefore make informed choices

On a related note, in 2014, RBS's Ross McEwan suggested that efforts to make banks more transparent about how they fund themselves would likely mean an end to free banking for in-credit customers.

From that, it's easy to see how an argument can be made for introducing fees for standard accounts - it would provide a much clearer picture of the actual cost and value of the services offered by each institution.

Basic accounts

Then there's the problem of the basic bank account.

An estimated nine million people in the UK have one, and while they too are free to operate, they come with stinging charges for failed payments and going into overdraft - although a deal made late last year means basic bank accounts will become truly free by the end of 2015.

Most of us accept that our banking comes with the odd fee for going into the red or missing a payment, but people with basic bank accounts often can't afford to make any kind of slip-up.

And while they're a vital service, the Government says the cost of providing them is an estimated £300 million.

The argument is that charging those who can afford to pay for their banking would help pay for those who really can't.

On this score, it's good to hear PWC's retail banking leader, Steve Davies, say that he foresees "a move towards tiered pricing and the retention of a very basic free product."

The end?

Finally, it's worth mentioning that doom-mongering is nothing new.

Back in 1996, the Independent reported how the Barclays Additions account - costing £5 a month - was being heralded as the end of free banking.

Almost 20 years later, the same warnings and issues are being raised, but we're still no nearer an upfront fee for running our finances.

Research from Consumer Intelligence suggests that about a quarter of us think we'll be paying for our current accounts within two years, a further 44% believe free banking as we know it will be around for the foreseeable future.

And it will take a brave bank to make the first move. As Steve Davies says:

"The risk of being left on their own would expose them to the high risk of losing customers and business."

In the meantime, the Competition and Markets Authority is investigating the current account market - citing, among other issues, the lack of clarity surrounding overdraft charges - mentioned above - as a barrier to healthy competition.

Perhaps it'll take the investigation - set to run into 2016 - to prompt the kind of shake-up PWC are predicting.

Receive consumer updates that matter in our newsletter

Receive consumer updates that matter in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties