Home > Energy > News > Customers punishing energy providers for price rises

Customers punishing energy providers for price rises

SCOTTISH Power and SSE have both released their quarterly financial results, revealing that they lost 330,000 customers between them in merely three months.

Their customer losses arrived in the wake of price rises, with Scottish Power announcing in February an electricity bill rise of 10.8%, and with SSE announcing a 14.9% increase for their electricity prices in March.

Given that something very similar happened to Npower after they announced rises of their own, this post-hike exodus seems to offer the encouraging news that competition is alive and well in the energy market, and that energy suppliers are finding it increasingly difficult to bump up their prizes and get away with it.

However, as heartening as the dip might seem to advocates of smaller suppliers, the longer term picture shows that customer numbers at the Big Six are relatively stable, and that the exodus will have to continue for several more quarters before suppliers respond by cutting costs and consistently offering more value for money.

Customer flight

Government lobbying risks high prices

Ofgem offer compromise on rebate

Customers moved as GB Energy collapses

Scottish Power and SSE released their quarterly statements on the same day, with the more significant coincidence being that both saw declines in their respective customer bases.

Scottish Power lost around 100,000 customers in the first three months of the year, while SSE lost 230,000.

Much the same story applies to Npower, who also recently saw a flight of customers.

In February, the German-owned supplier announced a 9.8% rise on their dual fuel bills. Clearly, this wasn't something their customers were entirely happy about, since in May Npower disclosed that they lost 211,000 of them in the first quarter of the year.

That said, the one difference between Npower's story and that of Scottish Power and SSE is that Npower aren't doing so well financially.

Their adjusted earnings before income and tax skydived by 74% in the first quarter to €34 million (or approx. £30.5 million), a fall which may not be helped in the next quarter now that they've haemorrhaged over 200,000 customers.

SVTs

While the cases of Npower, on the one hand, and of Scottish Power and SSE, on the other, differ in this financial respect, they both raise the question of why the three raised their prices, given that they lost customers as a result.

Because Scottish Power and SSE both enjoyed profits, they could have afforded to reduce their price rises somewhat so as to avoid repelling customers. By contrast, because they were in trouble and needed to gain rather than lose customers, Npower might have been better off keeping their standard variable tariffs (SVTs) down.

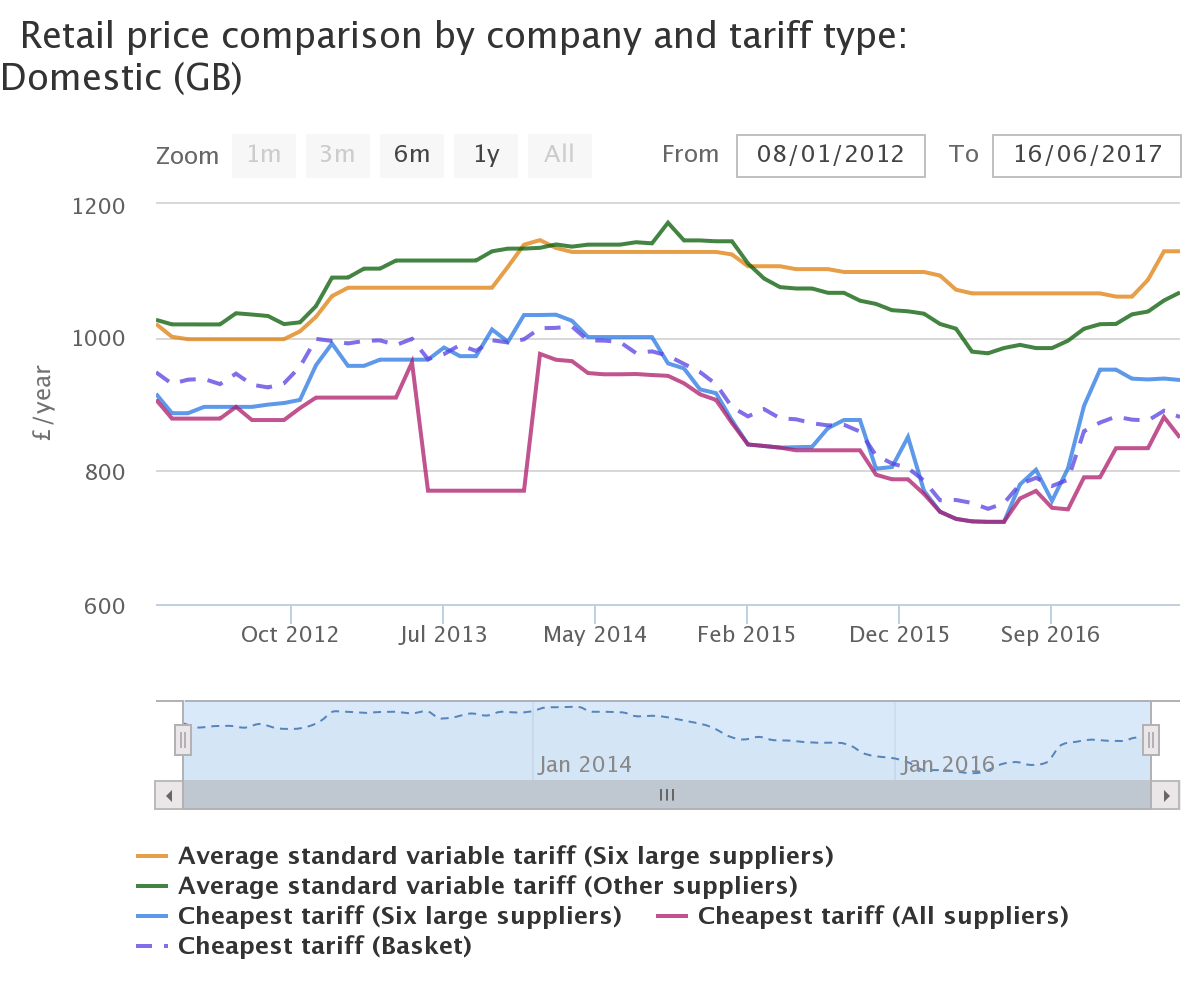

That both choose to increase their standard variable tariffs regardless is another indication of how bigger suppliers have a tendency to think customers on SVTs can be squeezed harder than other energy customers (as indicated by the graph below).

Source: Ofgem

This is tendency that has been observed in the recent, unpredictable campaign to have SVTs capped, with the likes of Citizens Advice pushing for at least a safeguard tariff to be introduced that will protect the UK's most vulnerable energy customers, who are more likely to be on SVTs than the general population.

It's therefore a welcome development that, in response to a wave of unpopular price rises, customers have decided to vote with their feet and leave some of the worst offenders.

Going to smaller rivals?

On the face of it, this might suggest that the SVT price cap mooted briefly by the Government (and then disposed of) might be unnecessary, since customers are punishing suppliers who raise prices too high.

However, the problem is that they aren't punishing suppliers enough, and thereby aren't creating enough of an incentive for providers to really keep their prices in check.

For example, Scottish Power noted in their quarterly results that they've "retained more of [their] customers over the last 5 years than any other large supplier", while other members of the Big Six have still managed to maintain their customer bases in the millions (e.g. Npower still has 4.7 million customers).

Part of the reason why they've managed to largely maintain their numbers despite increases in switching is that energy customers are mostly switching to other big suppliers, rather than to smaller rivals.

In the press release announcing a 30% increase in switches in 2016, Ofgem noted that only 47% of moves were to "small or medium suppliers".

Because of this, any departure of customers from Npower, Scottish Power and SSE isn't necessarily a cause of joy.

It could just mean that, instead of breaking the Big Six's stranglehold on the market, customers have simply moved to one of their similar large rivals.

And for as long as they continue doing this, they can probably expect to continue seeing their bills going up by more than they should.

Receive consumer updates that matter in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

2 January 2024

Energy prices increase by 5%

23 November 2023

Energy price cap to rise 5% in January 2024

24 October 2023

Energy companies must do more to support customers