If you've not yet heard of Monzo, they're a digital-only bank: they offer current account banking through a smartphone app.

But aside from not having a high-street presence, the Monzo current account does everything you'd expect - there's a MasterCard debit card with contactless payments, an optional overdraft, and customer service is available 24/7 through the app.

Want to speak to someone on the phone? You can do that too.

What does Monzo offer?

What's really different here though is that Monzo is actually offering more than most banks.

The Monzo banking app is a step above the sluggish, feature limited, banking apps from the high street brands we're used to.

Monzo offers real-time reporting of transactions, a range of budgeting features, and the ability to more easily send and receive money.

In addition, the Monzo current account offers free day-to-day banking, with no fees charged for purchases, cash withdrawals made in the UK, or money sent abroad.

When abroad purchases also remain free and cash withdrawals are free up to £200 per month, after which a 3% fee is charged. Making the account cheaper to use than typical UK banks.

And now Monzo offers a current account overdraft. Overdraft use is charged at 50p per day, capped at £15.50 per month, and there is a £20 free buffer.

Setting up

We decided to test out Monzo's banking app for ourselves after receiving a golden ticket from a long-standing Monzo customer.

It's worth noting, that after a period of limited registrations, Monzo is now open to everyone and you no longer have to wait for a golden ticket to jump the queue.

Registering for a Monzo account is incredibly simple and quick and was done entirely through the app on our iPhone. We entered our details to the app, made an awkward verification facetime video, and then sat back and waited for our card in the post.

Once our card arrived a few days later we were able to finish activating our account and could begin to use the services in full.

Our Monzo MasterCard arrived in the post in a few days.

We were given the option of taking an overdraft, which we declined at the time, but this can be added at any time via the account settings. We're not sure of the maximum available overdraft, but we were offered up to £1,000. So it's sizeable.

Monzo is part of the Current Account Switching Service, which means they will handle moving over all direct debits and bills to your new account and close down your old one.

Alternatively, you can switch your salary and bills manually if you wish. And as many of Monzo's customers seem to currently do, you can use the account as a second current account for day-to-day budgeting if you're not ready to make a full switch.

Smart budgeting

Probably the most notable selling point of Monzo after the low - or no - banking fees, are all the budgeting features on offer.

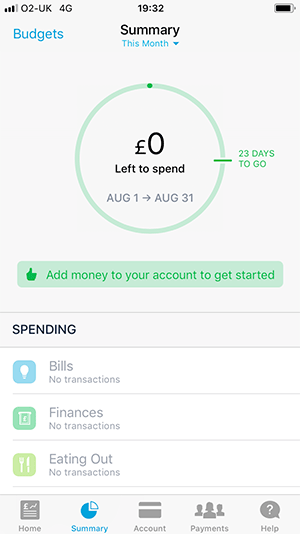

Monzo shows how much you have left to spend

Monzo's banking app works in real-time, which means you can see spending as soon as it's made, offering a greater sense of control and aiding with careful budgeting.

We really liked knowing exactly how much money we had available to spend, and the real-time reporting makes you feel much more in touch with your money and what you're spending it on.

There are a number of budgeting tools built into the app, including the ability to set spending levels for the month, as well as for up to 12 different categories, including Eating Out, Entertainment, Family, Groceries and Transport.

You can also separate out 'committed spending', which is direct debits, standing orders and online subscriptions - basically bills you know need to be paid, enabling you to more clearly see the money you have available to spend - or save.

And for saving, Monzo offers 'savings pots', which can be set up to move money aside for a holiday, large purchase, or a rainy day.

Monzo don't currently offer interest on credit balances, or savings pots, but when we asked them about this we were told it was "something we are hoping to implement soon".

Adding money

Money can be added to your Monzo account in one of three ways.

By bank transfer to an account number and sort-code.

By cheque in the post to - the shortest address we've ever seen - "Freepost Monzo" (yes that's really all you write!) - and it almost goes without saying 'no stamp needed'.

Or via Monzo.me - a unique online payment facility which can be used by both Monzo customers and non-customers.

Monzo.me is again free to use and receive money, although it does have a £1,000 monthly inbound limit, so it is certainly targeted at personal use rather than for taking (small) business payments.

Monzo.me does enable you to request payments however, and the recipient is sent a webpage in which they can make the payment.

From the app, the suggested use of Monzo.me is for example splitting the bill at restaurants.

Security

Any new challenger bank is going to have to prove its worth in both service and trust.

And Monzo seems to do that well.

Monzo is registered as a licenced bank under the FCA.

They also offer FSCS protection of up to £85,000 per account. That means should they fail; the Government guarantees to repay any customer balance up to £85,000 per account.

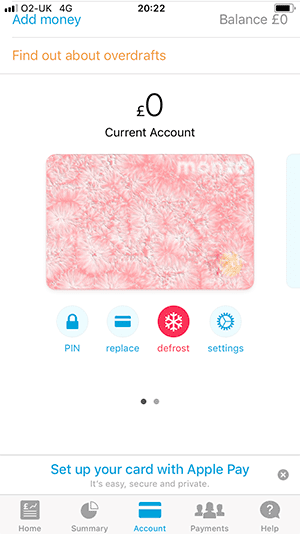

You can freeze - and defrost - the account

In addition to these standard features, Monzo does offer some of its own securities.

The banking app can utilise the location-based services of the smartphone (if you turn it on, as we found its off by default) - and that should a transaction come from a different location to where you are (or your phone is), that transaction would flag up as potentially fraudulent.

Tested on an iPhone 7 at least, Monzo offers touch ID to verify payments, and it's possible to set the app to request touch ID each time the app is opened. Although Monzo note that this doesn't encrypt data when the app is closed.

It's possible to freeze the debit card at the touch of a button in the app - if for example the card is lost or stolen. And when found, it can easily be 'defrosted' too. We think this feature will save a lot of hassle for the absent minded among us.

If you forget your PIN you can also use touch ID for a reminder.

A clearly socially aware development decision, albeit a bit confusing, Monzo offers an on/off setting to block gambling transactions. It's a lovely idea, but we can't help but think there is nothing to stop a gambling addict from opening their smartphone to disable the block.

Is this the future of banking?

We're really impressed with what we've seen from Monzo so far, and are struggling to find the drawbacks of this digital only bank.

Monzo now offer customers an optional overdraft

With the current account market reporting the lowest switching levels in comparison to other financial or telecoms products, we do think Monzo has their work cut out for them.

They reported heavy losses in the 12 months to February 2018 of £33.1 million, up from £7.9 million in the previous year.

While they say the majority of account running costs were as a result of a now discontinued prepaid card arrangement, they are faced with the fact many customers still only use the app as a secondary account, rather than as their principle account, noted by customer deposits being just £71.2 million, or £150 per account, last year.

In fact, even our golden ticket sender, who's been with Monzo since they started, still only uses their Monzo account for secondary budgeting and when abroad to save money on fees.

Monzo seem committed to offering a sustainable business however, and say they have reduced running costs by 80% per account, and that now more than 40% of customers deposit at least £500 every month. They also plan to increase their revenue by beginning to lend to customers with the launch of overdrafts.

But Monzo are going to need more customers - existing and new - to make a full switch from their old providers to using Monzo as a fully-fledged current account, and not just a budgeting app.

And they have their work cut out for them, considering just 3% of customers switched bank account in 2015-2016.

Verdict: would we switch to Monzo?

After trialling the app and reading up on how the bank operates to put our mind at rest to know our money is in safe hands, we fully intend to continue using the bank account and even consider making a full-switch.

It's not unheard of for new enterprises to fail, and in the energy market where there has been a flurry of challenger providers, many of these smaller businesses are now closing down.

Whether this will happen to Monzo is impossible to predict. But we're glad there are companies out there trying to change the banking industry to something that works a little more in favour of the customer.

In sum, Monzo are offering an enhanced service with their smartphone banking app, but they're doing it with a conscious too - offering either free, or where not, cheaper, banking.

And that's something the current account marketplace really needs to see.

Comments