Home > Money > News > Tax rules for couples too complicated

Tax rules for couples too complicated

Couples of all types would benefit from clearer, more consistent, rules when it comes to taxes and tax credits, a campaign group say.

The Low Income Tax Reform Group (LITRG) say in their report [pdf] into tax and welfare for couples that how partnerships are categorised for such purposes is "inconsistent, vague, and nearly always complex to apply".

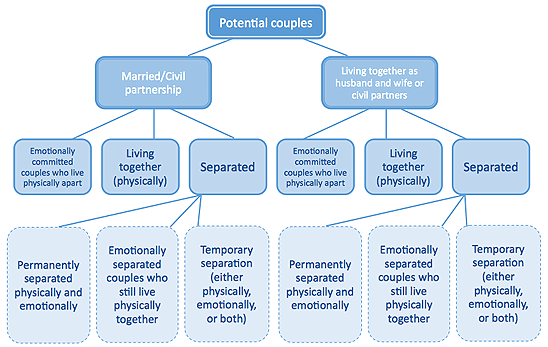

They highlight the contrasts between the situation for those recognised to be in an official partnership - whether marriage or civil - and those deemed to be cohabiting; they also raise the issue of how people with less conventional arrangements can be affected.

The group also suggest it may be helpful for those who aren't married or in civil partnerships to be able to register their status one way or the other.

What counts as a couple?

The main thrust of LITRG's argument is that definitions of what constitutes a couple vary depending on the tax or benefit in question.

One of the main stumbling blocks is whether or not the people in the partnership live together.

As long as two people are married, the rules regarding married couples allowance, transferable allowance for married couples, capital gains, and inheritance tax tend not to mind whether they live under the same roof or not.

In fact, with the exception of inheritance tax, one of the couple may even live outside the UK; as long as they're not officially separated or in the process of separating, they count as one unit.

SOURCE: LITRG, Couples in the tax and related welfare systems - a call for greater clarity, May 2015

But people who haven't married or entered a civil partnership don't get the same leeway regarding living arrangements - although as they also tend not to benefit from the same allowances, that's almost a moot point.

For example, an unmarried couple who've been living as if married for years, with children and thoroughly combined finances, still don't count as "a couple" in terms of transferable allowances, capital gains tax or - crucially - inheritance tax and other matters of inheritance.

So, for example, married couples and civil partners usually have the right to "inherit" their partner's pension, and receive bereavement support when one of the couple dies - but for unmarried couples the remaining partner generally has no such claim.

In addition, even the most devoted cohabiting couples will find themselves counted as single when it comes to the inheritance tax allowance. That means they can inherit up to £325,000 of assets tax-free; above that threshold they'll be taxed at 40%.

But a married or civil couple can combine their allowances - so either one of them can inherit an estate of up to £650,000 before having to pay tax.

The combined allowance also applies to the survivor should one of them die - meaning a widow can inherit twice as much before having to pay tax as an unmarried counterpart.

Stuck together

The diagram above also brings in the matter of separated couples who still happen to live together.

LITRG point out that there are many such "couples" who've had to stay together physically, if not emotionally, because of family or financial constraints.

According to the legislation regarding most taxes, they will count as "a couple" until one of the following occurs:

- they are separated under an order of a court of competent jurisdiction,

- they are separated by deed of separation, or

- they are separated in circumstances in which the separation is likely to be permanent

But the transferable allowance for married couples insists that marriage does not end until:

- a decree absolute of divorce, a decree of nullity of marriage or a decree of judicial separation, or

- in Scotland, a decree of divorce, a declarator of nullity or a decree of separation

The stricter interpretation for this tax benefit is understandable in a way; it's a measure the Conservatives proposed and brought in to encourage and support the notions of marriage and family life.

Tax credits

The situation with tax credits is somewhat different. They're a much more modern concept, and with the Tax Credit Act 2002 came solid recognition of cohabiting couples.

Technically, tax credits also recognise that not all couples live together, while other benefits still require that couples must be members of the same household.

But in reality this tends only to apply to those who are married or in civil partnerships; they'll be considered a couple whatever their living arrangements.

They'll also find it slightly easier to cease being considered a couple, as again they can get and provide proof of separation.

Cohabiting partners, however, have no such fallback should they break up but not be able to physically separate.

That means that anyone beginning the process of splitting up will often be deemed to be part of a couple for tax credit purposes until they can prove otherwise.

That can seriously affect how much money they're entitled to receive; couples tend to be treated as joint applicants for many benefits, and will receive less than single people.

But as mentioned, there's a sizeable group of people who may have split from their partners but are stuck living with them because of money issues - and not being able to get extra financial support won't help them out of that situation.

Registering - or not

So what of the LITRG's call for people to be able to register whether they're part of a couple or not?

It's more that they're commenting on the fact that there isn't a way for people to state categorically whether or not they're in a committed partnership for tax and benefits purposes.

The report stops short of suggesting that people who aren't married should be able to "declare that they wish to be treated as married".

Instead it asks that people should be able to say "I am in a couple" - or otherwise, should something go wrong - and that the onus would then be on the different Government departments to apply the rules as they currently stand.

This, they say, would help reduce instances of fraud, and prevent thousands of people from being chased to repay overpayments made in error.

Given that the people affected by efforts to reclaim tend to be among the most financially vulnerable, that could save an awful lot of stress - and expense for the Government.

Receive consumer updates that matter in our newsletter

Receive consumer updates that matter in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties