Home > Broadband > News > ISPs failing to entice new customers because of 'high prices'

ISPs failing to entice new customers because of 'high prices'

INDUSTRY analysts have claimed that internet service providers (ISPs) are struggling to gain new broadband customers, pinning the slowdown in customer growth on high prices and a failure to innovate.

Speaking to the Financial Times, experts from various telecoms consultancies warned that providers such as BT and Sky Broadband were relying less on net customer additions to grow their revenues and more on higher fees, something which has had a depressing effect on the market's expansion.

However, as Choose have already explored in an article from last month, the slowdown in customer growth isn't general to all ISPs, with some bucking the trend to increase their customer base in recent quarters.

Yet an important point can nonetheless be extracted from the downturn in customer additions of certain ISPs, which is that the UK's politically charged drive to bring superfast broadband to the entire country isn't quite translating to the kind of superfast take up many would have wanted.

Analysis

Three plan to roll out ultrafast network

Broadband rollout scheme on track

Ad body set new standards on broadband

In much the same vein as we did so a month ago, the bulk of the FT's analysis focuses on the mixed fortunes of BT, who posted their most recent quarterly financial results at the beginning of May.

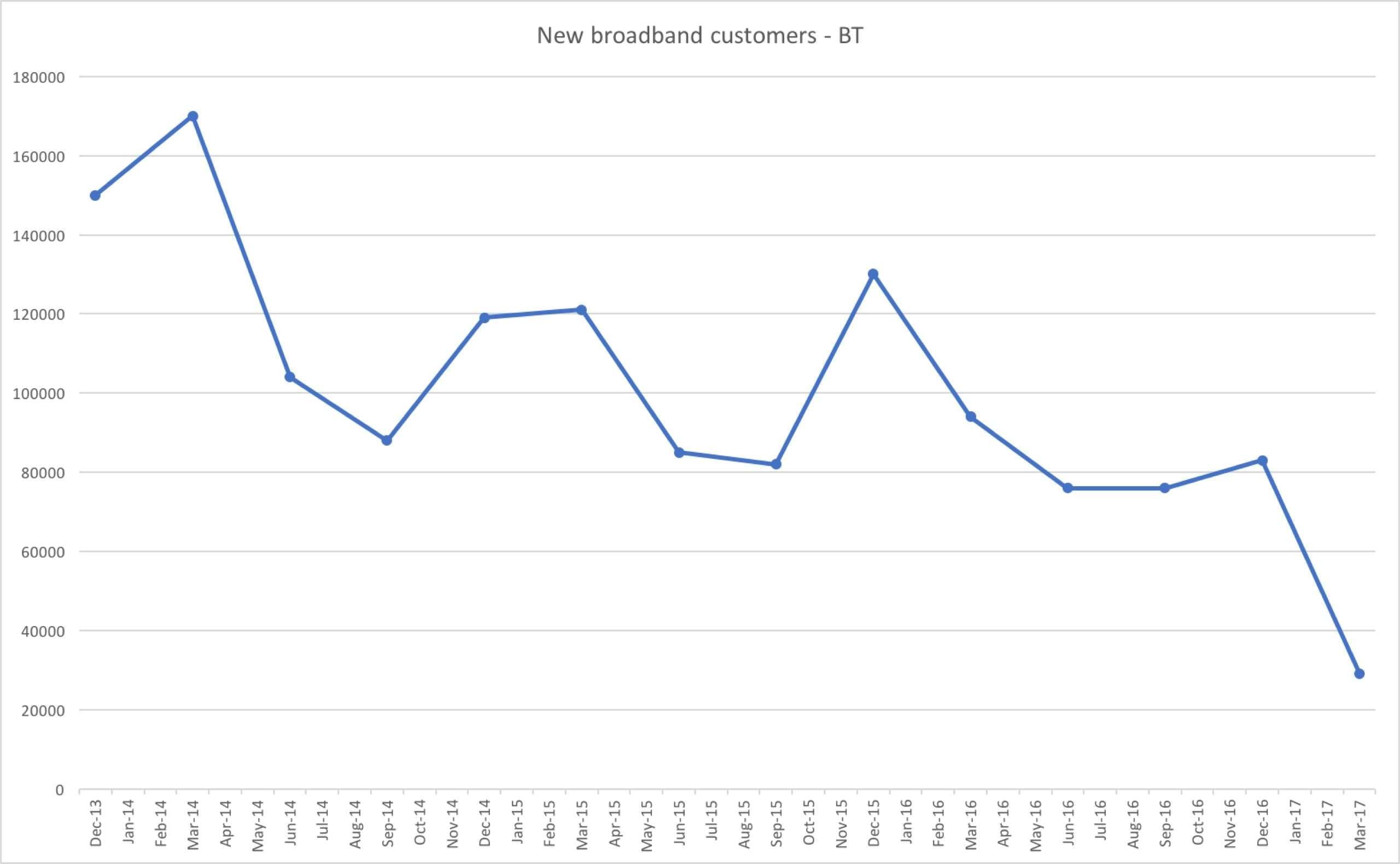

They recorded 29,000 new broadband customers, and as the table below highlights, this number is a far cry from the kinds of figures they were recording in previous years:

Source: BT Group plc.

It's largely on the basis of such a dramatic decline that a variety of analysts have now suggested that the entire market is going through something of a crisis, brought on partly by the fact that providers have been raising their prices.

BT, for example, announced in January that their broadband subscription fees would be rising in April by £2 or £2.50 a month, while Sky confirmed a similar £1.59 rise to landline fees soon after.

Yet it wasn't simply a hike in prices that was identified by the FT and its quoted analysts, with an absence of innovation being another major suspect.

For example, Guy Peddy of financial services firm Macquarie stated, "There has been no product innovation for a long time. It's just speed and price. It is harder to raise prices without innovation".

And because an absence of innovation has been coupled with higher prices, ISPs have witnessed a worrying decline in new customer additions.

Other ISPs

However, while there's no question that BT are going through something of a malaise at the moment, it's not entirely accurate to jump to the conclusion that the entire UK broadband industry is going through much the same.

It's suggested by the FT that providers such as Virgin Media and Sky are also struggling, with Virgin's revising down of plans for the expansion of their Project Lightning being the main support for such a diagnosis.

And yet, even though Virgin Media did overstate the number of new connections added to their network in 2016 by 142,000 premises, they have been doing relatively well in adding new broadband subscribers.

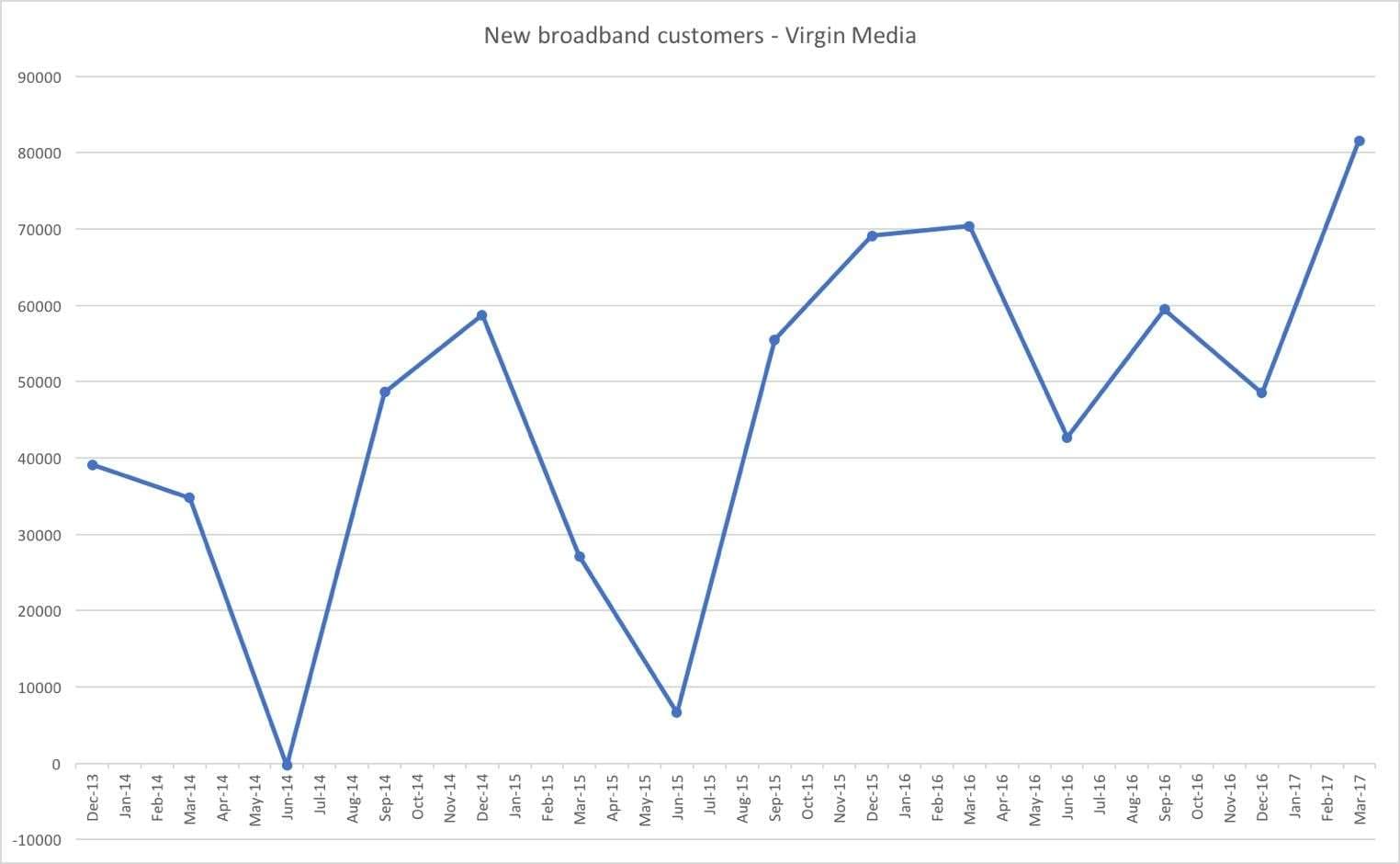

As the table below reveals, they added 82,000 new customers in the first quarter of 2017, their best ever total:

Source: Liberty Global plc.

Similarly, TalkTalk - for all their legacy problems from the October 2015 hack - enjoyed their first quarterly growth in broadband customers in three years this year, adding 22,000 new subscribers.

And as for Sky, while they haven't released numbers for new broadband customers separately from their numbers for new customers in general, the latter have been more or less stable, with 106,000 new customers joining them in the latest quarter.

Innovation

Such figures reveal that the downturn in customer growth is really focused mostly on BT.

Added to this, the theories offered by the analysts above can be criticised for another reason, which is that, rather than there being a lack of innovation in the broadband market, there is perhaps far more than many customers want or can afford.

For instance, even with superfast broadband - which is hardly a new technology anymore at over 90% coverage - take up was only 31% as of June 2016, when Ofcom published their most recent figures on broadband subscriptions.

Given that less than half of the UK don't seem to have much demand for even superfast broadband, it would seem to be a mistake to assume that one of the main problems for ISPs is their failure to feed a demand for new products.

And in the end, it's perhaps this absence of sufficient demand which is perhaps one of the biggest problems facing the broadband industry. Or, at the very least, BT.

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

13 February 2026

Sky TV bundles Netflix, Disney+, HBO Max and hayu

13 February 2026

Telecoms Consumer Charter promises no surprise bill hikes

8 February 2026

TV licence to rise to £180 from April 2026Receive consumer updates that matter in our newsletter