Home > Money > News > How much is debt really costing us?

How much is debt really costing us?

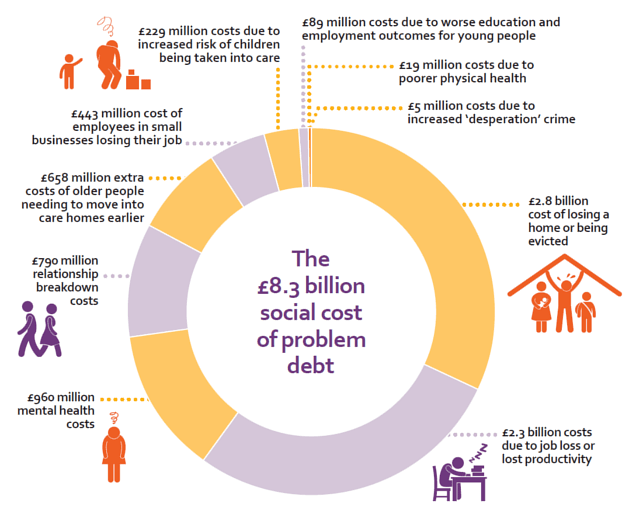

DAMAGE to family life, mental and physical health, and productivity and work life caused by problem debt, and the resulting costs to the welfare state, costs the UK £8.3 billion, a charity says.

This "social cost" is on top of the £162 billion of outstanding consumer credit in the British economy.

StepChange Debt Charity took into account the impact of factors like the breakdown of relationships, lost productivity or loss of employment, and the effect on children's well-being and future prospects.

The charity say the advice it gave more than 230,000 users helped save society £241 million over the course of the 12 months up to September 2013. They say that if all 2.9 million people with problem debt in the UK got effective debt advice, social costs of £3.1 billion could be saved.

Who has problem debt?

StepChange consider someone to have problem debt if they find themselves doing three or more of the following:

- Using credit to keep up with essential bills

- Using credit to keep up with existing credit commitments

- Using credit to last until payday

- Making minimum payments on a credit card for longer than three months

- Falling behind on essential bills

- Regularly facing late payment charges

The organisation says those most at risk of finding themselves in this situation are households with average incomes, families with children and those in full time work.

These are the people its Life on the Edge report [pdf] points out are "the very definition of the 'hard working family' that many Government policies set out to help."

StepChange admit its figure of 2.9 million people having problem debt is a "conservative estimation", adding that the Money Advice Service reckons 8.8 million are "indebted" - but that figure includes people who are highly vulnerable to getting into debt.

In all, it's reckoned that 15 million people in the UK satisfy at least one of the above criteria, and some 25 million people say they feel like they're juggling their finances all year, not just at seasonal peaks.

What costs what?

SOURCE: StepChange Debt Charity, Cutting the cost of problem debt 2014.

For many older people, the stress of dealing with debt can contribute to deteriorating health and the need for earlier and extra social care.

The link between money worries and mental health has been made before, and the financial industry is rightly subject to regulation when it comes to dealing with people vulnerable to mental health issues.

But what if it's the debt that's causing the problem?

Last month StepChange announced that almost one in seven British adults has difficulty sleeping because of money worries.

Meanwhile Citizens Advice says 73% of the people who come to them for help with debts say their money problems are making them feel stressed, depressed or anxious.

Lost childhood

The report says problem debt costs some £310 million when children are involved. Damaged education and employment prospects cost £89 million, and a further £229 million results from the increased risk of being taken into care.

Children from families with problem debt are more than twice as likely to be unhappy at school, or bullied because they don't have the same things as their friends.

Almost 60% of children in families with problem debt say they worry about their family's financial situation.

And some 90% of families say they have cut back on food, clothing or heating for their children to stay on track with debt repayments.

What can be done?

StepChange saw a 37% increase in people seeking debt advice from 2012 to 2013, and expects a further 20% increase in client numbers by the end of 2014.

So they want more to be done by Government, local authorities and others to help prevent debt happening in the first place.

"Lifting the scourge of problem debt and helping prevent it occur in the first place makes sound economic sense," says chief executive Mike O'Connor.

"We need to see a concerted effort, especially with interest rate rises around the corner, by public bodies, lenders and charities to help people who are in trouble now or are in danger of getting into difficulty."

Help on dealing with debt

StepChange: On budgeting for debt

Debt Support Trust: Repayment options

Suggested measures include "early warning systems" for creditors, so they know if and when a customer is facing financial difficulties, and can offer advice and support.

And they want more to be done to support increased levels of saving, as StepChange says UK households save less than almost every other country in the EU.

Finally, they propose "breathing space schemes", for people who realise they are in financial trouble, seek help and try to repay their debts - including protection from growing interest charges and enforcement action.

The report suggests that without such changes, and soon, that £8.3 billion could well grow.

Receive consumer updates that matter in our newsletter

Receive consumer updates that matter in our newsletter

We are independent of all of the products and services we compare.

We order our comparison tables by price or feature and never by referral revenue.

We donate at least 5% of our profits to charity, and we aim to be climate positive.

Latest News

26 October 2022

Cost of living showing worrying trends in affordability

16 June 2022

FCA warn lenders on cost of living difficulties